Testimony

How to Improve State Budgeting Practices

The following testimony was given at the Pennsylvania Fiscal and Economic Summit at York College on August 22, 2019.

Thank you for the opportunity to address you this morning on “Improving State Budgeting Practices.” The problems, as we at the Commonwealth Foundation see them, are that the state operating budget is growing too fast and that the administration frequently overspends even that budget.

We have a number of proposals to address both problems, some of which are included in bills that are before the legislature in the current session. I’ll address the growth of the budget first and the overspending of the budget second.

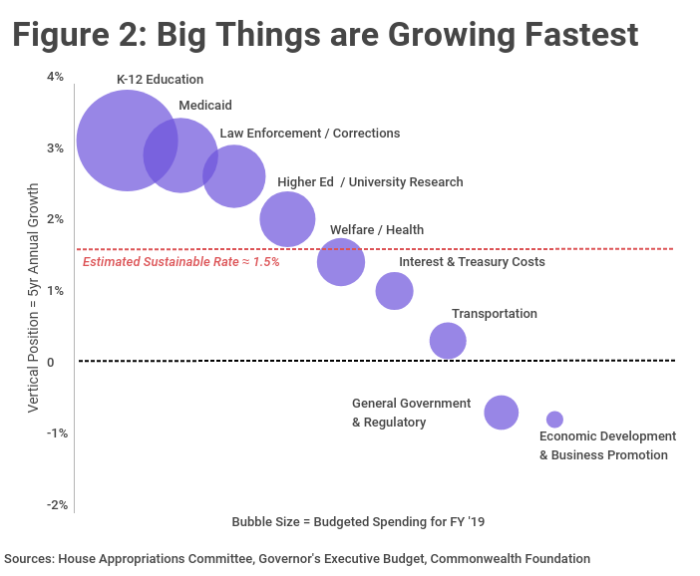

Spending out of the major revenue funds grew 2.3% per year on average over the past five years. We estimate the sustainable growth rate for total spending was closer to 1.5%. That’s a billion dollar spending difference over the period. We estimate the sustainable spending growth rate as the sum of inflation and population growth. If spending is growing faster than the sum of those two numbers, it means that the government’s share of the economy is growing. Government programs can’t outgrow the economy on which they depend or taxes eventually have to go up.

The most important recommendation I have for you today is to pass the Taxpayer Protection Act (SB 116, HB1316)(“TPA”), which would encode the sustainable spending growth rate into law as an annual legal limit on the growth rate of general fund spending. If the TPA had been in place over the last 15 years, the savings would have totaled more than $10,000 for every family of four in this state.

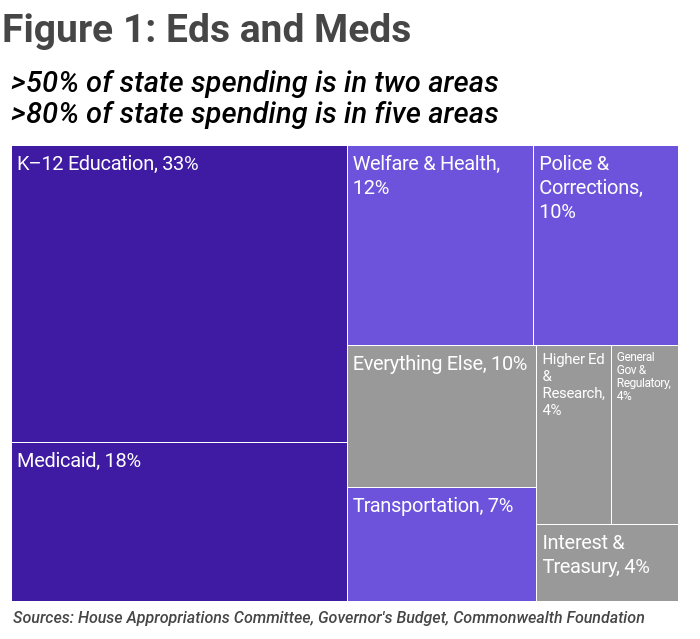

Given a hard limit on the growth of government, we will have some choices to make. The two charts in my printed materials illustrate the problem. As you can see in Figure 1, half of all state spending (at least, spending from the main revenue funds), is “eds and meds:” K-12 and Medicaid. Add welfare, police and corrections and you’re at about 3/4ths of all spending. Figure 2 shows you that those big areas are also the ones that are growing unsustainably. Consider that over the past five years, the dollar growth in K-12 and Medicaid alone were greater than the growth in everything else combined. Clearly, then, the growth of the government can’t change if the growth of these few big items doesn’t change. These may not be the most politically profitable areas to scrutinize, but doing it is the only way the budget can be brought under control. My colleagues have written up plenty of specifics and I would be happy to elaborate in the question time.

In addition to the arithmetic behind the need for a spending limit, there’s also a good-governance argument: the legislature ought to be making thoughtful trade-offs about where taxpayer dollars are spent. Pre-K or state parks? More money to Penn State or more money to prisons? Is $48,000 per inmate per year the right price for keeping somebody locked up? This is the logic a household or a business uses in writing a budget, but it isn’t how we’ve historically made spending decisions in Harrisburg. The situation in Pennsylvania has too long been to let everything grow at the same time. The top line number grows without a limit, and then the need for new revenue is declared as fait accompli. We never get around to choosing. TPA will force us to choose.

I’ll turn now from how to limit the growth of the budget to how to keep from overspending it once it is enacted.

In the fiscal year just ended June 30, the administration overspent by $673 million, mostly in the area of Human Services, where it had rather obviously underbudgeted up front. That is to say, this wasn’t a mistake: the administration spent in violation of the balanced budget amendment. But there wasn’t much accountability or transparency about this. A supplemental appropriation for that amount was simply tucked in to the appropriations bill for this year. The trick only worked because there happened to be some extra revenue: tax revenue came in higher than expected. There doesn’t appear to be a backup plan for if it hadn’t.

In order to introduce some visibility and potential accountability, the Commonwealth Foundation agrees with the idea put forward by Rep. Grove and Sen. Philips-Hill to pursue a constitutional amendment proposal requiring any supplemental spending to be voted on in a stand-alone appropriation, not hidden in the omnibus legislation for the following year. This would make budget overruns more visible and quite frankly put every legislator on the record as saying “yes” or “no” to them. An important reform already passed in this year’s administrative code bill requires any year-end supplemental appropriation request to include an explanation and a planned remedy for the future, but this needs to be backed up with an enforcement mechanism or it won’t have much effect.

Any kind of requirement that would create more accountability or transparency during the budget year would also be welcome. HB 855, which passed the House in June and is now in the Senate Appropriations Committee, would allow for department budgets to be adjusted intra-year if the administration’s revenue projections given revenue collections are falling short. This is an excellent reform to put in place now while revenue and the economy are strong, because they won’t be forever.

Lastly I would like to touch briefly on off-budget and government-related spending. Spending from the general fund is running at about $34 billion and all appropriated spending out of the General, Motor License and Lottery funds is about $40 billion. That is the number I used to compute the percentages and the growth rates I’ve been quoting to you. But there’s actually another $45 billion of annual spending under state control that comes out of what we call the “shadow budget,” the set of about 150 state special funds, often with narrow purposes or dedicated independent revenue sources. These include the Public Transportation Trust Fund, the Gaming Fund, the Keystone Recreation, Parks & Conservation Fund, and many others.

The shadow budget should not be used to hide spending growth by funding things that ought to be funded out of the general fund. An example of that I can give you is that prior to 2016 the state was spending about $95 million annually out of the General Fund to pay the debts of the Commonwealth Financing Authority (“CFA”). Those payments are now made from elsewhere and the General Fund Spending on the CFA is minimal. But the expense didn’t go away. To take the money out of a different pocket doesn’t constitute a spending cut, and the General Fund is still on the hook for any shortfall. That being said, special revenue funds appear to be hoarding resources. The state’s cash balances are about $12.5 billion according to the state treasurer’s web dashboard. With the exception of a very small reserve those monies should be spent down or otherwise released instead of tapping new revenue sources or borrowing for capital projects. The government should use the resources it has on hand, not grab for new ones while sitting on billions in cash.

Thank you for your consideration.