Media

Gov. Rendell Left Pennsylvania a Big Deficit

Recent headlines have former Gov. Ed Rendell challenging Gov. Tom Corbett on the issue of the deficit he left the current administration. Gov. Corbett has campaign ads stating he closed a $4.2 billion budget deficit. Gov. Rendell recently claimed he left Corbett a $1 billion surplus.

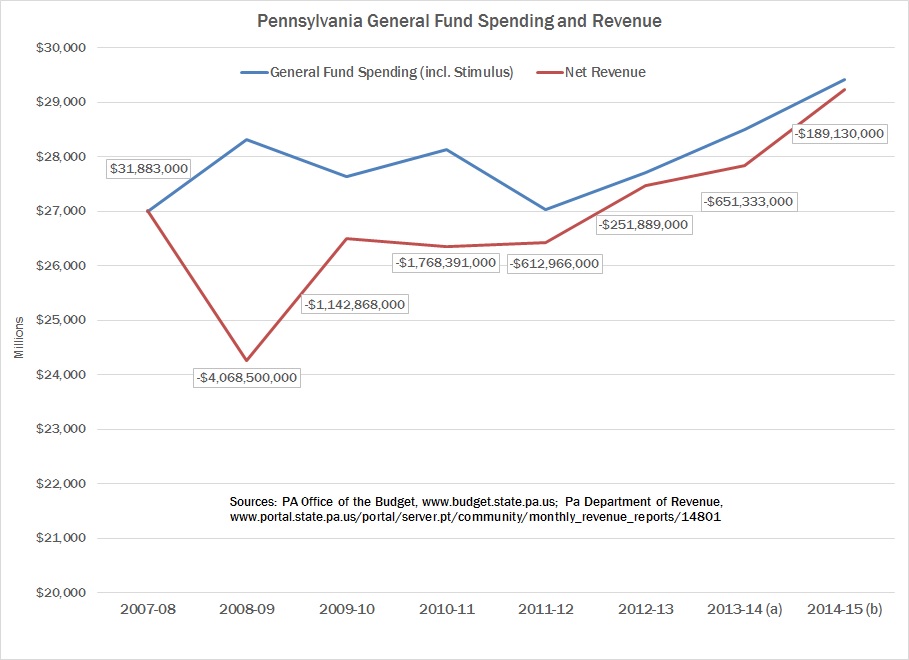

Gov. Rendell’s claim is the easier to address—he is simply using the word “surplus” incorrectly. When he says “$1 billion surplus,” he means there was a fund balance just over $1 billion in June 2011—effectively, there was money remaining in the state’s bank accounts. But spending exceeded General Fund revenue in each of Gov. Rendell’s last 3 budgets.

Make no mistake, by any accounting standards, or just the dictionary, this is considered a “deficit.” No business or household could claim to be running a surplus simply because they had some money in their checking account at a certain point in time.

The question is exactly how large the deficit was when Gov. Corbett took office. The “$4.2 billion deficit” comes from Gov. Corbett’s first budget proposal. It is based on the fact that the 2010-11 budget included $2.65 billion in federal stimulus funding, $750 million in one-time revenue, and $665 million in one-time revenue reductions (see page 4 of the slide presentation).

This overstates the amount of cuts Gov. Corbett had to make to balance the budget. As noted above, the state wasn’t spending every last dime in 2010-11 (though some lawmakers wanted to), giving some leeway. Revenue also increased in 2011-12, and both Gov. Rendell and Gov. Corbett made some freezes to 2010-11 spending.

By the end of fiscal year 2010-11, the state had spent about $1.8 billion more than it collected in revenue.

Perhaps the most important thing taxpayers should know is that the state has been spending more than it collects in revenue for six straight years. Gov. Corbett’s proposed budget would make that a seventh year.

This deficit spending was made possible through temporary federal stimulus funds, one-time transfers from other funds (like the Rainy Day Fund and the MCare Fund), and spending down the remaining fund balance.

Gov. Corbett has done well to balance the budget, given the deficit left to him, without raising the income or sales tax. But we aren’t out of the hole yet, as the state continues to deal with a structural deficit.

Moreover, this problem will only get worse. The commonwealth continues to pay less than it needs to for pension costs, given the artificial caps set by Act 120 of 2010 (indeed, Gov. Corbett’s proposed budget includes lowering these caps further).

Because of rising pension payments, along with welfare spending that continues to grow faster than our economy, the Independent Fiscal Office projects the deficit to grow to $2.1 billion by 2018-19. Years of overspending have created a structural deficit in Pennsylvania, and it’s still here.