Fact Sheet

2014 Pennsylvania State Budget

Governor Corbett’s proposed budget of $29.4 billion in General Fund spending (a 3.3% increase) and $71.8 billion in spending from all funds represents Pennsylvania’s highest spending levels ever—exceeding years when federal stimulus dollars were used to balance the budget.

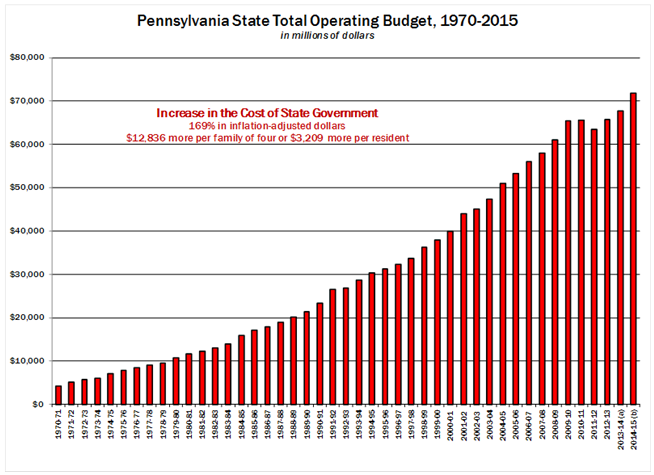

Spending Outpaces Inflation

- Pennsylvania’s fiscal challenges persist due to the state’s inability to rein in spending. From 1970 to 2015, state government increased spending from $4 billion to a proposed $71.8 billion, an inflation-adjusted increase of $12,836 per family of four (or $3,209 more per resident).

- If state government had limited its total spending growth to inflation and population since 2000, taxpayers would be saving nearly $15.3 billion this year, or $4,767 per family of four ($1,194 per person).

Pennsylvania State Budget Basics

While the General Fund Budget is the primary focus of both legislative discussions and public attention, it represents only about 40% of the commonwealth’s total operating budget.

- Total Operating Budget (estimated) – $71.8 billion

- General Fund Budget (proposed) – $29.4 billion

- Federal Funds (estimated) – $24.2 billion

- Special Funds (estimated) – $4.8 billion

- Other Funds (estimated) – $13.3 billion

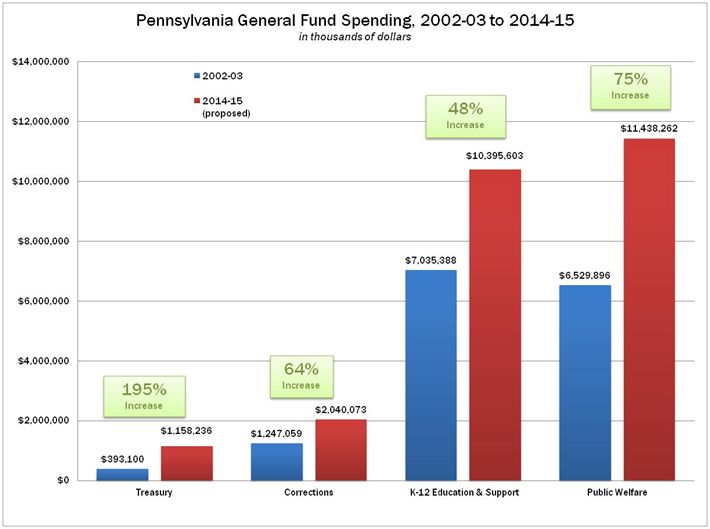

- General Fund spending has increased by approximately $8.7 billion (42%) since FY 2002-03, not including spending directed to other funds.

- The four largest departments (Welfare, Education, Corrections, and Treasury) represent about 86% of all General Fund spending.

- Since FY 2002-2003, the budgets of these four departments have increased by more than $10 billion (60%) and are projected to increase even further, threatening Pennsylvania’s fiscal health

Rising Debt and Tax Burden

- From 2002 to 2013, Pennsylvania state debt—including debt held by state agencies—more than doubled, from $23.7 billion to $50.4 billion.

- Today, Pennsylvanians owe $128.6 billion in combined state and local government debt, or a little more than $10,000 for every man, woman, and child.

|

Pennsylvania State & Local Government Debt |

||

|

Debtor |

Debt Outstanding |

Per Person |

|

Total State |

$50,429,717,000 |

$3,948 |

|

State |

$11,188,917,000 |

$876 |

|

State Agencies & Authorities |

$39,240,800,000 |

$3,072 |

|

Total Local |

$78,216,434,000 |

$6,123 |

|

School Districts |

$27,278,259,814 |

$2,315 |

|

County/Municipal/Twp/Other |

$50,938,174,186 |

$3,988 |

|

Total |

$128,646,151,000 |

$10,071 |

|

Sources: Governor’s Executive Budget (http://www.budget.state.pa.us) December 2013 data; PA Dept of Education (http://www.pde.state.pa.us) June 2012 data; U.S. Census Bureau (http://www.census.gov/govs/www/estimate.html) 2013 data |

||

- Pennsylvania has the 10th highest state and local tax burden in the nation, up from 24th in 1991, according to the Tax Foundation.

- Pennsylvania taxpayers pay $4,374 per person in state and local taxes, or 10.3% of the state’s total income.

Pennsylvania is Overspending

- For the seventh consecutive year, Pennsylvania will spend more from the General Fund than the state will collect in taxes.

- Federal stimulus funds, transfers from the “rainy day fund,” and other one-time revenue sources have allowed lawmakers to spend beyond the state’s means for years.

- Pennsylvania will begin next fiscal year with an estimated $216 million remaining in General Fund accounts and end with $20 million (based on the proposed budget)—spending $189 million more than state revenue.

- The budget also assumes reduced pension payments (which require legislation) and federal approval of “Healthy PA” to move some Medicaid recipients off of state funding and onto federally-funded Healthy PA.

Education

- Governor Corbett’s budget proposal calls for $10.4 billion in funding for public schools and support services, the highest level in state history.

- Governor Corbett’s proposal includes nearly $400 million in new spending, including a $240 million student-based supplement as part of the Ready to Learn block grant.

- Despite the claims of billions in cuts from the education budget, the $10.4 billion represents an increase of 3.1% over 2010-11 spending (which included federal stimulus funds) and 9.9% since 2007-08 (the last budget balanced prior to federal stimulus funding funds) and 9.9% since 2007-08 (the last budget balanced prior to federal stimulus funding).

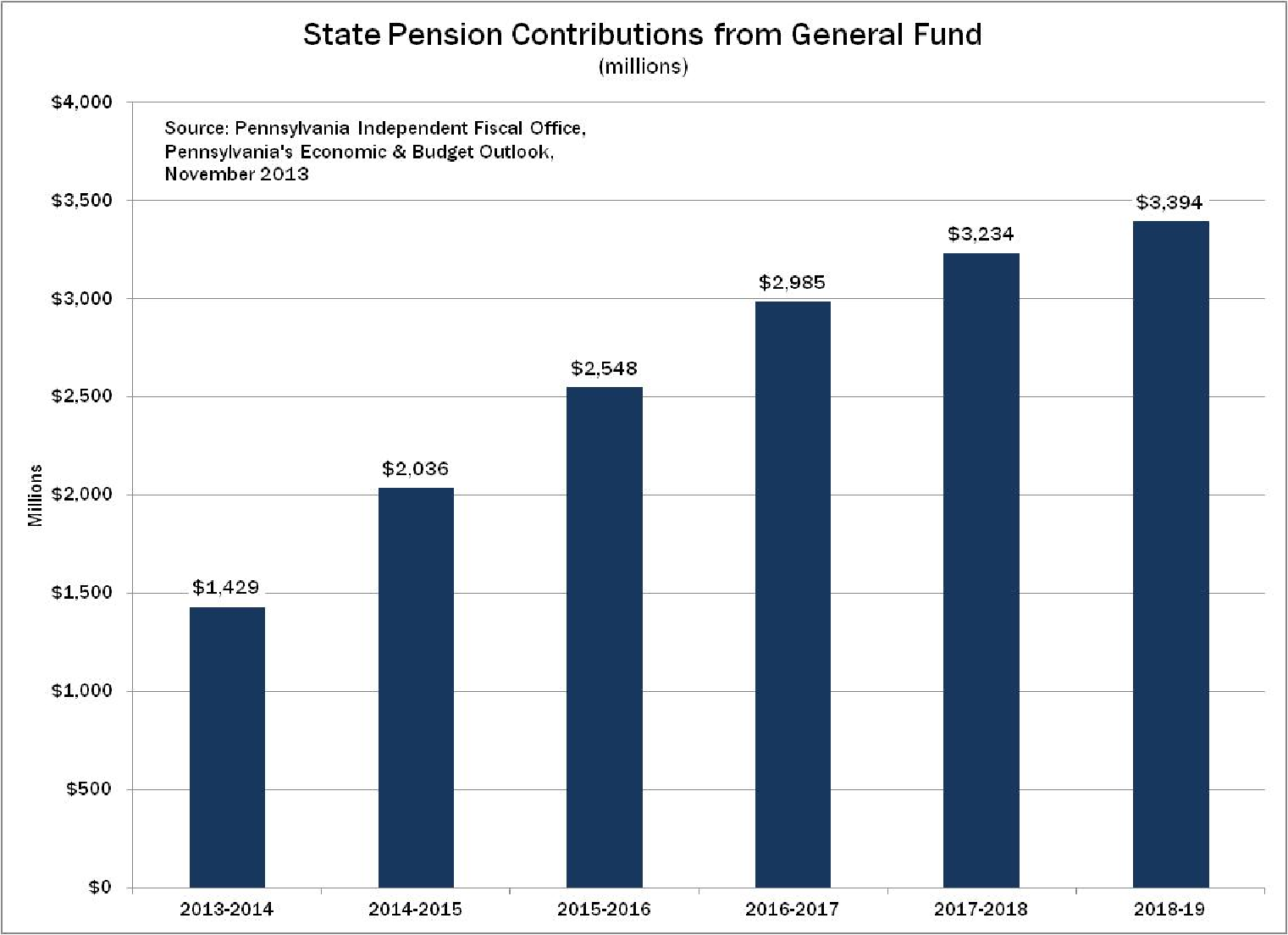

Pensions

- Pennsylvania’s unfunded pension liability—the amount the state should have in its pension funds earning interest to be able to make payments for the benefits retirees and current workers have earned—now exceeds $50 billion.

- Because of past policy decisions, this unfunded liability will continue to grow, even as pension contributions rise.

- Taxpayer costs for pensions are scheduled to skyrocket over the next few years. In the state General Fund alone, pension contributions are projected to increase nearly 143% by 2018-2019, from $1.4 billion to almost $3.4 billion. School districts will face similar increases in their pension contributions.

- The total increase, between the state and school districts, amounts to almost $900 per household.

Overspending Hampering Economic Growth

- From 1991 to 2013, Pennsylvania has ranked a dismal 44th in job growth, 38th in personal income growth, and 46th in population growth. This contrasts sharply with the robust economic growth in low-tax, low-spending states.

# # #

To find more information on Pennsylvania’s State Budget, visit CommonwealthFoundation.org/Budget