Media

What Is in the House Budget?

Last night, the Pennsylvania House Appropriations Committee advanced a $31.6 billion general fund budget. This budget is now lined up for a final vote in the House.

Here is what you need to know about the budget.

The Good

- Spends less than Gov. Wolf proposed. The $33.3 billion budget Gov. Wolf outlined was never seriously considered, given how far it was outside the realm of political possibility. Still, this budget would spend $1.7 billion less than Gov. Wolf offered.

- No income or sales tax increases. Last week, Gov. Wolf and legislative leaders declared that “broad-based tax increases”—which mean the state sales tax and personal income tax—were off the table for this budget.

The Bad

- Spending growth 5 times the rate of inflation and population growth. The $1.5 billion increase represents a 5% increase in a year when inflation is less than 1%. This kind of spending growth is unsustainable.

- Requires more than $1 billion in new revenue. To generate $31.6 billion in revenue, lawmakers are looking to tax amnesty, revenue from the wine reforms passed earlier this month, expanded gambling, and new and higher tobacco taxes. Revenues from sin taxes are unpredictable and decline over time, while tax amnesty and aspects of the gaming expansion and wine reform are one-time revenue streams. If these revenue estimates fall short or fail to grow, lawmakers may be looking at a personal income or sales tax increase next year to bridge the gap.

- Raises taxes. The legislature has not yet agreed to a specific tax package. We know that it will include a $500-$600 million increase in the cigarette and other tobacco taxes. These taxes fall primarily on low-income households and result in increased smuggling across state lines. There have also been rumors of a tax increase on homeowners’ natural gas heating bills and a tax increase on bank savings accounts.

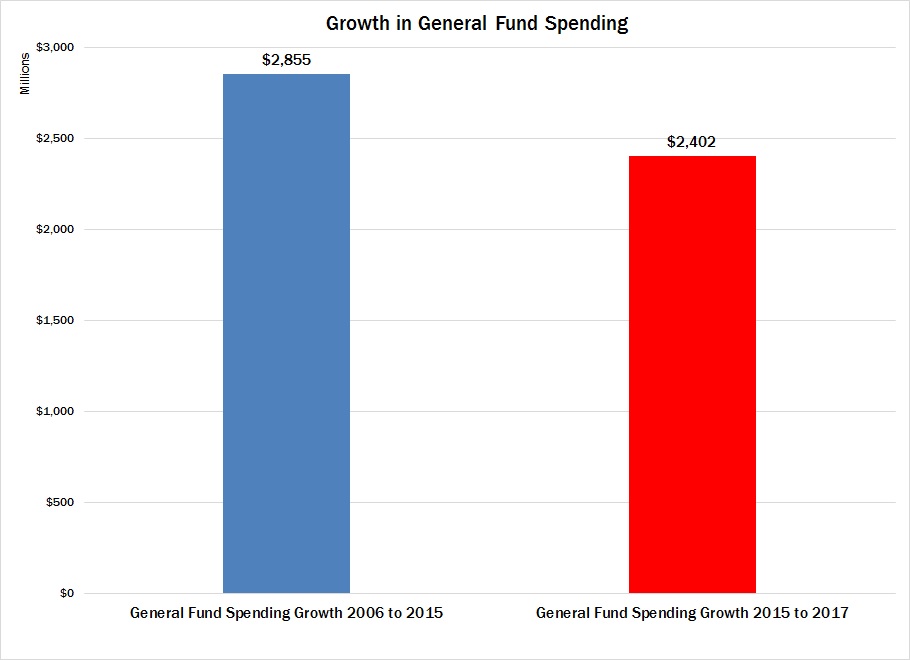

- Biggest spending increase in a decade. The $1.52 billion increase in spending over the enacted budget represents the largest year-over-year increase since 2006-07. (The bill also includes $100 million in “supplemental appropriations” to be spent as part of the 2015-16 budget). Moreover, the $2.4 billion increase in Gov. Wolf’s first two years approaches the $2.85 billion general fund spending increase in the prior eight years combined.

- Doesn’t include needed spending reforms. The new budget doesn’t address the $700 million in corporate welfare the Commonwealth Foundation has identified. Nor does it tackle reforms to slow the unsustainable growth of human services spending. There is much more the legislature and Gov. Wolf can do to prioritize the use of taxpayers’ dollars before calling for more taxes on families.

Where is the new spending going?

- $10 million more for Community and Economic Development, a 4.6% increase.

- $44 million more for Conservation and Natural Resources, a 71% increase. This increase stems from Gov. Wolf’s decision to bar extracting gas under state lands, shorting the Oil & Gas Fund and leaving taxpayers to foot the bill.

- $153 million more for Corrections, a 6.8% increase.

- $665 million more for K-12 education, a 6% increase. This includes $345 million for school pensions, $200 million for basic education, $25 million for government-run preschool, and $20 million for special education.

- $452 million more in Human Services (formerly Public Welfare), a 3.9% increase.

- $18 million more for the General Assembly, a 6.3% increase.