Media

Governor Wolf’s Sixth Tax Hike Plan

As noted in previous posts, Gov. Tom Wolf has proposed tax hike totaling $2.7 billion over a full year—or $850 per family of four. About half of this increase comes from raising the personal income tax rate.

This proposal also includes retroactive increases in the income tax, along with bank shares and insurance premiums taxes. That is, the higher tax rate would be effective beginning on January 1, 2016, and (if passed) you would owe additional taxes on money you've already earned.

Including the tax hikes residents will pay in the first half of this year (for the 2015-16 budget), state government will take $1,129 more per family of four over 18 months.

The table below summarizes the proposed tax hikes in Wolf's 2016 budget.

| Gov. Wolf's Proposed Tax Changes (2016 Budget Proposal) | ||||

| Item | 2015-16 | 2016-17 | ||

| State Tax Rate Changes | Total Revenue | Per Family of Four | Total Revenue | Per Family of Four |

| Severance Tax of 6.5% – July 1, 2016 (existing impact fee payments deducted) | $0 | $0 | $217,800 | $68 |

| Personal Income Tax rate increased to 3.4% – January 1, 2016 (RETROACTIVE) | $587,600 | $184 | $1,361,500 | $425 |

| PIT imposed on Lottery winnings – January 1, 2016 (RETROACTIVE) | $0 | $0 | $16,300 | $5 |

| Sales Tax (6% rate) imposed on basic cable television, movie theater tickets, and digital downloads. Limit vendor discount for sales tax collection to $25 per month – April 1, 2016 | $38,300 | $12 | $414,600 | $130 |

| Bank Shares Tax rate increase to 0.99% and change base – January 1, 2016 (RETROACTIVE) | $39,300 | $12 | $39,200 | $12 |

| Insurance Premiums Tax surcharge of 0.5% (fire, property, and casualty insurance) – January 1, 2016 (RETROACTIVE) | $81,500 | $25 | $100,900 | $32 |

| Cigarette Tax increase of $1 per pack – April 1, 2016 | $116,000 | $36 | $468,100 | $146 |

| Other Tobacco Product Tax (smokeless tobacco, large cigars, loose tobacco, and e-cigarettes) of 40% – May 1, 2016 (July 1, 2016 for loose tobacco) | $10,000 | $3 | $136,000 | $42 |

| Tax on Casino Promotional Play (free games offered by casinos) of 8% – January 1, 2016 (RETROACTIVE) | $19,900 | $6 | $50,900 | $16 |

| Income Tax Forgiveness Program | $0 | $0 | ($83,400) | ($26) |

| Total State Tax Increases | $892,600 | $279 | $2,721,900 | $850 |

| Source: Governor's Executive Budget. Total Revenue in Thousands | ||||

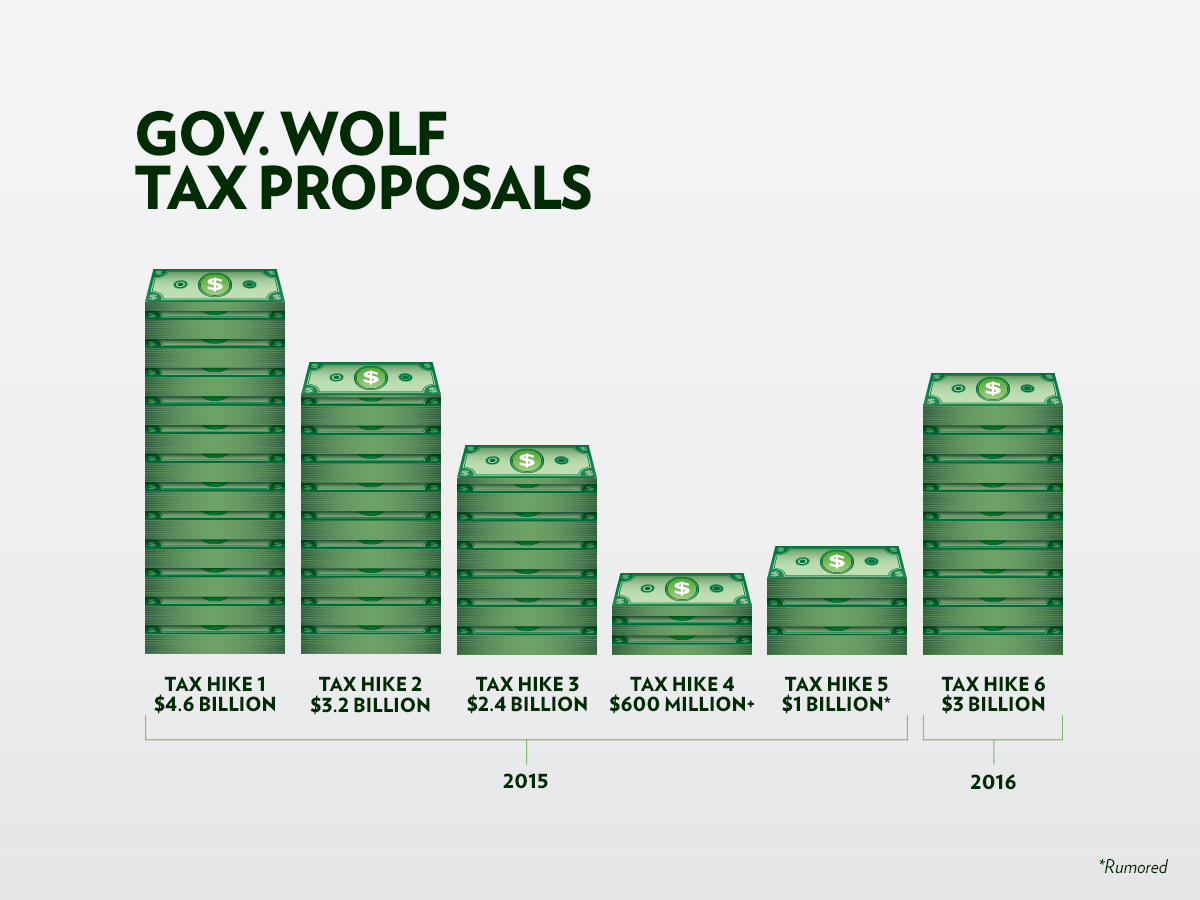

Readers will note that this new tax proposal—really the sixth one Wolf has pushed for—resembles his first tax hike proposal (which received no support, even from his own party). The total dollar amount is a bit less, and he dropped his proposal to increase the sales tax rate and to tax things like nursing homes and day care under the sales tax.

Yet overall, Wolf is pursuing the same ideas lawmakers have rejected. Here is a brief history of Wolf's tax hike proposals.

You can send a message to your elected officials about these tax hikes at PleaseNoMoreTaxes.org