Media

Five Facts about Wolf’s Second Budget Proposal

More of the same

- Wolf’s proposed budget mirrors what he offered—and lawmakers repeatedly rejected—last year: Massive tax hikes and record spending increases.

- It’s no surprise Wolf didn’t want to give this “repeat” speech on Groundhog Day.

- Wolf’s proposed spending increases continue a long trend. Total state spending increased in 45 of the last 46 years for an inflation-adjusted total of $16,557 more per family of four.

Biggest spending increase in 25 years

- Wolf’s $33.3 billion General Fund budget (including pension payments) represents a 10 percent increase over the budget passed by the legislature in December.

- This is the largest spending increase since 1991-92.

Wolf’s tax hike = $850 more per family four annually

- Including the tax hikes residents will pay in the first half of this year (for the 2015-16 budget), state government will take $1,129 more per family of four over 18 months.

Even more money for public schools

- Wolf’s budget includes a $1.1 billion increase in support of public schools, on top of the record-high level of funding passed by the legislature in December. This increase comes with no accountability measures.

- Wolf wants $400 million more in public school spending for the current school year—which is already more than halfway over.

- Meanwhile, Wolf proposed arbitrary and punitive cuts for public charter schools, including cyber charters.

- New data from the National Center for Education Statistics shows Pennsylvania already spends $3,400 more than the national average per student, including higher per-student funding from state tax dollars.

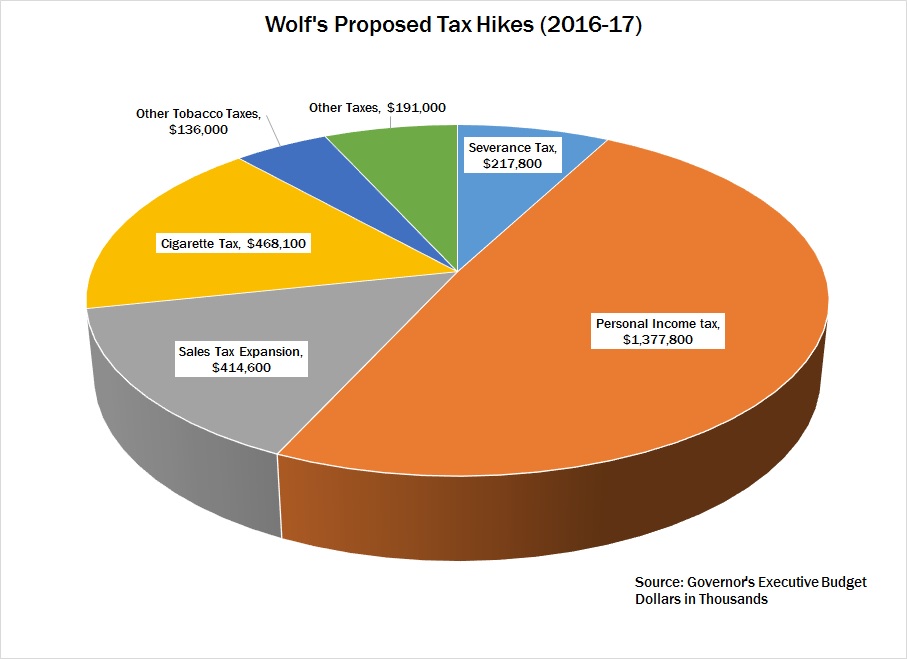

At least 8 different tax increases, including

- An 11 percent personal income tax hike—retroactive to January 2016 (in other words, you already owe the state more taxes);

- Sales tax expansion to cable TV, movie tickets, and digital downloads;

- Higher taxes on natural gas production, even as the industry is laying off workers across Pennsylvania;

- Higher cigarette taxes and new taxes on other tobacco products, hitting lower-income families the hardest;

- Higher taxes on bank savings and home insurance premiums; and

- New gaming taxes.