Media

Pay No Attention to Those Tax Increases!

The liberal Pennsylvania Budget and Policy Center—an arm of the union-funded Keystone Research Center—has a new claim that Gov. Wolf's “property tax relief” is similiar to that in a bill passed by the House of Representatives earlier this year.

Unfotunately, PBPC's analysis offers virtually no discussion of the tax increases in these plans.

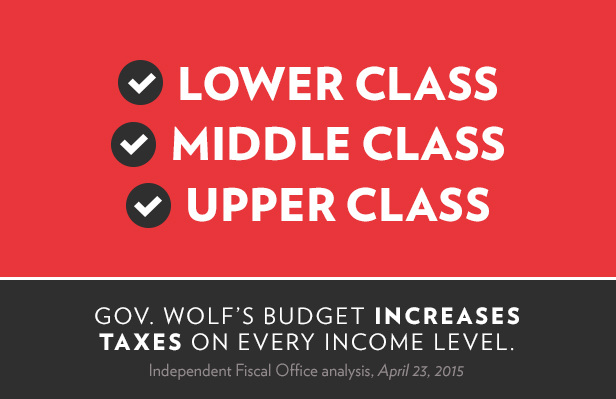

For starters, PBPC never mentions that Gov. Wolf’s tax plan, overall, is a net increase of $3.8 billion in 2016-17, according to the IFO. This jumps to a net increase of $5.2 billion in 2019-20. The same IFO report finds that households in every income bracket would pay more in net taxes under Gov. Wolf’s plan.

Yet, PBPC's news release claims Wolf’s plan has “similar sales tax increases as in the House plan” and says the plans raise “revenues from the sales tax by similar amounts.”

In reality, Wolf’s tax plan calls for almost $4 billion in higher sales tax revenues in 2016-17, compared to $1.7 billion in HB 504.

Those totals are nowhere close to similar. That’s the equivalent of saying a 6-foot tall man and a 2-foot, 6-inch child are similar in height.

| Tax Increases, Reductions Full Year Effects (2016-17/2017-18) in millions |

||

| Wolf Plan | HB 504 | |

| Income Tax Increase | $2,396 | $2,710 |

| Sales Tax Increases | $991 | $1,655 |

| Expansion | $2,979 | $0 |

| Total Sales | $3,970 | $1,655 |

| Total Sales + Income | $6,366 | $4,365 |

| Other Tax Increases | $1,009 | $0 |

| Total Tax Increase | $7,375 | $4,365 |

| Property Tax Reductions | $2,732 | $4,160 |

| Rent Rebates | $369 | $125 |

| Philadelphia Reductions | $452 | $0 |

| Total Reductions | $3,553 | $4,285 |

| Net Tax Increases | $3,822 | $80 |

| Source | IFO | Fiscal Note |

PBPC notes that Wolf’s plan calls for much more in additional spending than the dollar for dollar shift in the House bill, but claims this is “substantially paid for by a proposed severance tax on gas drillers.”

I guess that depends on what your definition of “substantially” is—but about $3 billion of the $3.8 billion net increase in 2016-17 is paid for by taxes other than the severance tax (primarily the excess sales and income tax increases).

Meanwhile, neither plan addresses the inherent flaws in tax shifting. By relying only on a shift, taxpayers will still be hurt—even if in state taxes rather than in property taxes—by the cost drivers in education, including pension costs, mandated costs, and unaffordable union contracts.

Tax shifting creates winners and losers—families that would pay more under the shift and districts that would pay more under the shift. The PBPC analysis fails to consider this at all.

The House Appropriations analysis shows that 80% of school districts would pay more in income and sales taxes under Wolf’s plan.

Finally, PBPC's assertions about how we fund schools are misleading. Our state funding per student is similar to the national average, and overall, Pennsylvania schools spend about $3,000 more per student.

Moreover, our high poverty schools spend more than high poverty schools nationwide.

Claims of “similarity” aside, the truth is that Wolf's tax plan would cost Pennsylvanians dearly.