Media

State Budget: Fireproofing the Economy or Throwing Gas on the Fire?

Let’s pretend you’ve been financially struggling recently, have spent your savings and pushed off paying some of your bills. But here’s some good news: You have $500 in your checking account, and you expect a $400 raise next month.

The bad news is your bills next month are going to be higher too:

- Your minimum credit card payment will increase by $80 next month;

- Your health care premium will rise by $840;

- Your retirement contribution next month will be an extra $690;

- And your rent is set to rise by $135.

That’s $1,700 in additional costs next month. What would you do to prepare? Would you spend the $500 in your checking account on a shopping spree today?

That is exactly what many in the state legislature propose doing in budget talks—only adding a “million” to each number.

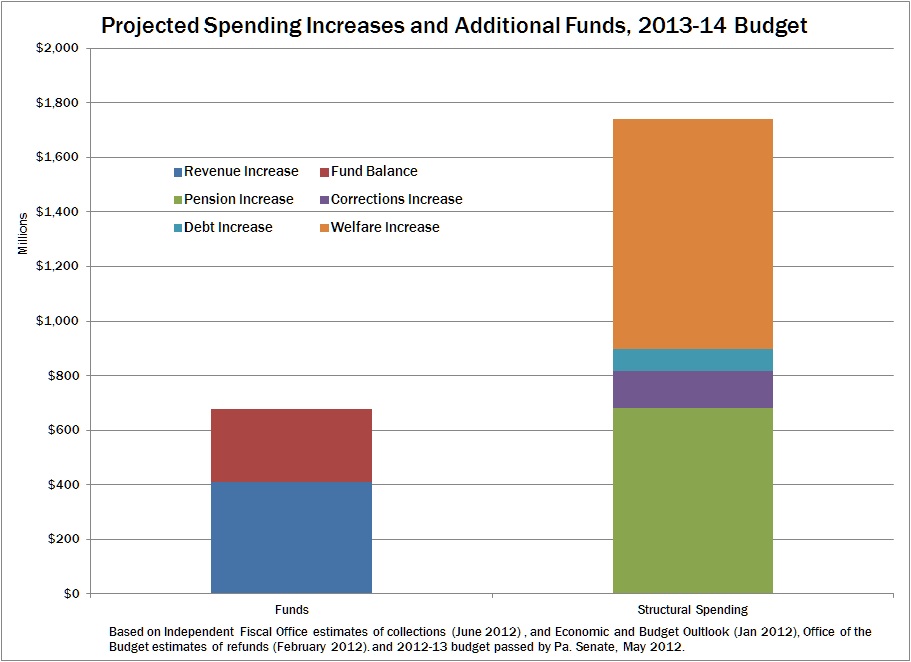

State payments for debt, welfare, pensions, and corrections will continue to rise next year. Combined, these will consume an extra $1.7 billion in 2013-14, based on Independent Fiscal Office projections, growing far faster than revenues. Where will lawmakers get the money?

While the state General Fund will have about $500 million remaining by the end of June to help address future costs, some would like to spend every cent of that.

Of course, doing so means that the state would spend more than it’s collecting, and have nothing left to address the four alarm fiscal fire facing the state. Lawmakers need to control spending now to fireproof Pennsylvania’s economy.