Media

Chart of the Day: Shale Growth Fuels Tax Growth

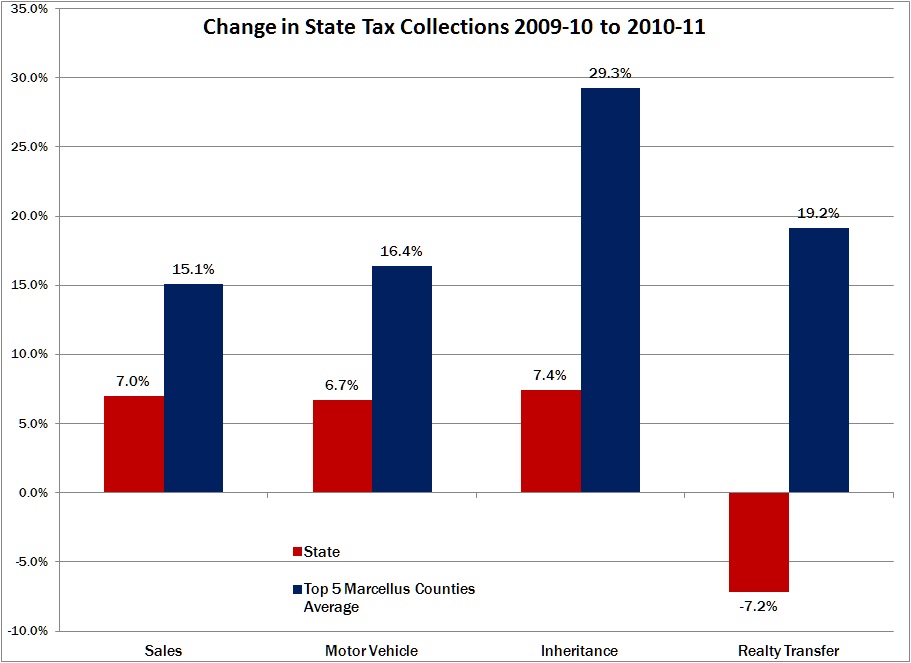

We noted previously how the boom from Marcellus Shale natural gas has fueled a dramatic increase in state corporate tax collections. Pennsylvania Department of Revenue data also show a major increase in other state taxes in counties with shale drilling.

The top five drilling counties in 2011 (Bradford, Lycoming, Susquehanna, Tioga and Washington) saw sales tax collections grow by 15 percent last year, more than double the state totals. Motor vehicle sales tax and inheritance taxes (partly due to dramatic wealth increases) in shale outpaced state growth even more dramatically. And realty transfer taxes—on homes sold—grew by 19 percent in shale counties while declining statewide. Indeed, the shale boom is one of few things keeping the housing market from continuing its decline.

When debating an “impact fee,” lawmakers must consider the tax revenue already being generated from natural gas drilling and related economic growth.