Media

State Budget Gaps and State Budget Growth

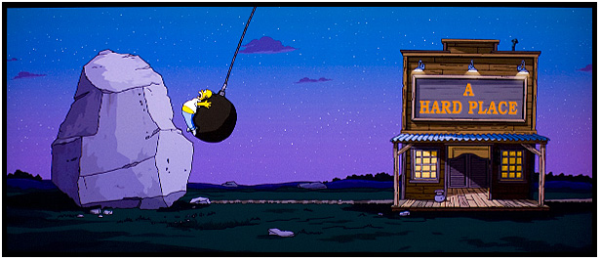

In a recent report, Matthew Mitchell from the Mercatus Center provides solutions to the “rock and hard place” situations states are finding themselves in while they try to reconcile state budget deficits.

The study looked at each state’s policies and approaches that lead to each state’s budget predicament. The patterns that emerged provide lawmakers an idea what not to do:

- State governments that spent a larger fraction of state income – and had done so for many decades – experienced smaller percentage budget gaps in FY 2010. That is, states that historically spent more per person had lower budget shortfalls, perhaps due to the fact that their tax systems supported over-spending, contrasted with states that recently increased spending during boom times.

- States whose per capita spending levels increased the most over the last two decades had larger percentage budget gaps in FY2010.

- States whose policies permit economic freedom (lower taxation and less regulation) and states with strict balanced budget requirements experienced smaller budget gaps.

Pennsylvania was rated among the states with “weak balance budget requirements” because it allows the deficit to carry over to the next year. States with strict balanced budget requirements had budget deficits 8% to 10% less than the average state.

Based on the report’s findings, Pennsylvania can decrease its budget gap by ending deficit rollovers, lowering taxes, reducing regulations, and restraining spending growth.