Media

Yes, a Severance Tax Will Discourage Drilling

The Philadelphia Inquirer recently depicted Gov. Rendell as willing to compromise on a natural gas severance tax in Pennsylvania, asking the industry to accept a fair severance tax. In reality, the drilling industry that has been working towards a “modest and reasonable severance tax.”

Sharon Ward, director of the Pennsylvania Budget and Policy Center was quoted expressing opposition towards the Governor’s new proposal, saying “it’s just unnecessary to give the industry a break,” because a severance tax won’t discourage drilling (nor does she understand what a “tax break” is). Secretary John Hanger, former PennFuture head and fan of subsidizing alternative energies while taxing gas, claimed that, “in private, the gas companies are practically laughing at their ‘good fortune’ of not having to pay a severance tax in Pennsylvania.”

Most states with shale formation similar to Marcellus Shale offer exemptions and tax incentives – like Arkansas, one model Gov. Rendell is now considering. You can find a list of states’ natural gas severance taxes here.

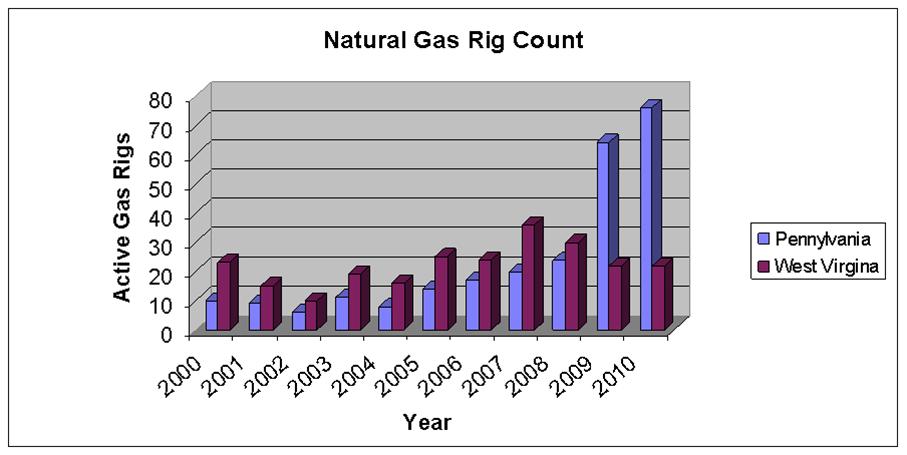

Perhaps severance tax lovers should look at the difference between drilling in West Virginia, the model for Rendell’s original severance tax proposal, and Pennsylvania.

Perhaps severance tax lovers should look at the difference between drilling in West Virginia, the model for Rendell’s original severance tax proposal, and Pennsylvania.

The price for natural gas has plummeted from $13 per 1,000 cubic feet in 2008 to around around $4 this year. The industry isn’t striking gold right now, but making financial investments for the future. Drilling in Pennsylvania costs, on average, $1 million more than in other states because of extensive permitting and environmental regulations.

It is ignorant to believe a tax won’t matter. Lawmakers need to reduce state spending and stop looking for new industries to tax. Gov. Rendell’s proposal to mimic Arkansas’s severance tax is a step in the right direction. However, any tax revenue should be tied to environmental costs, not the General Fund, where the Governor plans to send 90% of the revenue.