Commentary

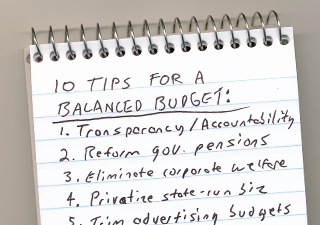

Ten Tips to Balance the Budget

Contrary to Gov. Rendell’s rhetoric, there are a plethora of reforms and cuts that can balance the budget without taking more from the pockets of Pennsylvania taxpayers. Here are ten ideas to balance the state budget, this year and the years to come, without raising taxes:

1. Start with Transparency and Accountability. Creating a publicly accessible online spending database, such as that proposed in House Bill 1880, would discourage the misuse of tax dollars. Texas saved over $5 million by putting spending online. HB 1880 unanimously passed the House in December, and remains in the Senate State Government Committee.

2. Pension Reform. Beginning in 2012-13, taxpayer contributions to state and public school employee pensions will increase dramatically, resulting in state and school property taxes rising by as much as $1,360 per household. Newly hired teachers and state workers should be put into a defined-contribution plan, similar to a 401(k). New Jersey and Illinois are reducing benefits for new hires and placing part-time employees into a defined-contribution plan. The costs associated with defined-contribution plans are affordable for taxpayers and predictable for policymakers.

3. Eliminate Corporate Welfare. Pennsylvania doles out the 2nd highest amount of “economic development” in the nation, $754 million in FY 2010. These grants and loans to politically-connected special interests – such as Harley Davidson, alternative energy companies, and Hollywood filmmakers – have hindered, rather than helped, job growth in Pennsylvania.

4. Privatize State-Run Businesses. Taxpayers are burdened a variety of enterprises that could be run by the private sector, including museums, parks, and state liquor stores. Instead of allocating millions to the Museum and Historical Commission and a billion dollars to the Liquor Control Board, Gov. Rendell should consider leasing contracts and encourage individual philanthropy. Competitively contracting all state liquor stores could produce a one time influx of $1.7 billion, increase future revenues through corporate and property taxes, and provide better service to consumers.

5. Reduce Advertising Budgets. Taxpayers shell out $37 million annually for lottery advertising and over $5 million to promote tourism. Lottery advertising is particularly disconcerting because the money spent aims to convince the public that they have a good chance of winning.

6. Cut Legislative Perks. The General Assembly enjoys a variety of costly perks. Legislators can collect $163 daily for food and lodging expenses, without producing receipts. Legislative leadership accounts, budgeted at $21 million for FY 2010-11, are used to reward rank-and-file members and have funded illegal bonuses. Returning to a part-time, citizen legislature would increase accountability and cut down on self-serving government.

7. Reform Medicaid. At the current rate of growth, Medicaid will consume 94% of the state budget by 2075. Recent performance reviews by the Auditor General found that the program was wrought with fraud, waste, and outright theft – identifying upwards of $1 billion of ineligible payments. Creating a voucher system for recipients would give individuals more control over their health care spending and reduce waste and fraud.

8. Corrections Reform. Corrections costs continue to skyrocket, with a $137 million increase in this year’s proposed budget. Absent reform, the state will be 11,000 beds short by 2011. Probation and parole should be used more often for non-violent offenders, such a drug users and geriatric inmates. The state should also consider contracting out prison services or privatizing the prisons themselves.

9. Promote School Choice. Over the past 25 years, per-pupil spending has increased by 364%, while achievement has stagnated. Last year, the innovative Educational Improvement Tax Credit was cut, even though the program saved taxpayers over $500 million in 2007-08. Lawmakers should embrace charter schools, home schooling, and cyber schools which cost much less than public schools and improve student learning.

10. Repeal Prevailing Wage Laws. Prevailing wage laws make government construction contracts more expensive by forcing contractors to pay higher wages than those paid by the private sector for the same job. This inflates costs by upwards of 30% and increases spending by state and local government by almost $9 billion.

These recommendations are just a few ways state government can trim the fiscal fat while delivering essential services to citizens. Examining how each dollar of the $66 billion state budget is spent, prioritizing programs, identifying waste, and finding more efficiencies is critical to restoring Pennsylvania’s prosperity.

# # #

Elizabeth Bryan is a Research Associate at the Commonwealth Foundation www.CommonwealthFoundation.org, a public policy education and research institute located in Harrisburg.