Media

Who Pays Pennsylvania’s Personal Income Tax? Part III

Pennsylvania has a flat rate Personal Income Tax (PIT) of 3.07%. In this blog series, I will highlight some real facts about Pennsylvania’s PIT. Visit Who Pays the PIT by Income and Who Recieves Tax Forgiveness

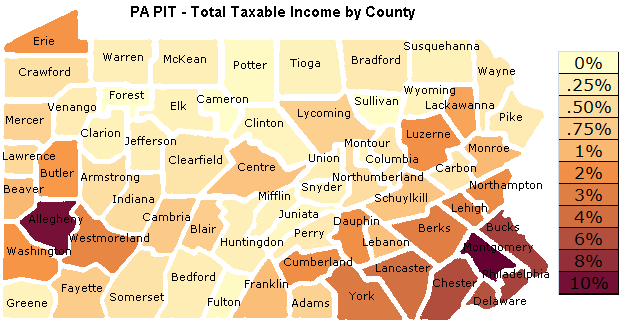

Part 3: County Distribution of PIT

There are 67 counties in Pennsylvania, but most taxable income comes from only a few counties. Data from the 2006 shows that the SE region of Pennsylvania (Philadelphia, Montgomery, Delaware, Bucks, and Chester) comprised 28% of tax returns and provided for 36.2% of total taxable income. The greater SE region (including Northampton, Lehigh, Berks, Lancaster, and York) comprised 43.7% of tax returns and provided for 51.4% of total taxable income. These 10 counties provide the majority of taxable income.

Montgomery County is the top tax producer, at 10.9%. Allegheny ranks second, at 9.89%

On the flip side, the least populous 40 counties comprised 16.2% of tax returns and provided for 12.2% of total taxable income.

5.2% of total taxable income was provided from outside the state of Pennsylvania.

See what percentage of taxable income your county provided by looking at the map below or the chart.