Media

Use School Reserves to Fund Pensions

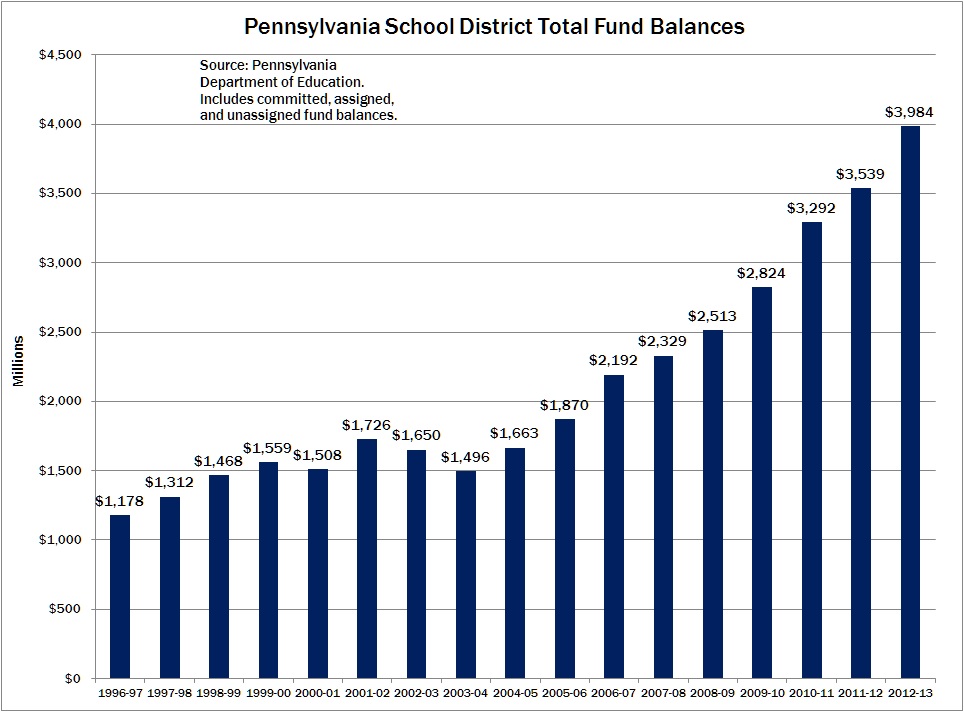

In 2013, Pennsylvania school districts increased their reserve funds by $445 million—to a total approaching $4 billion as of June 30, 2013—according to the latest data from the Department of Education.

Including charter schools and CTCs, public schools had more than $4.2 billion in total fund balances.

While this increase in reserve funds undermines that narrative that public schools have been “cut to the bone,” there are good reasons why school districts have built up massive reserves.

Many school districts have rationally grown their reserve funds to deal with the coming spike in required contributions to teachers’ pensions.

However, taxpayers would be better served if public schools invested these funds in the pension system now, got investment returns, and paid off part of our more than $50 billion unfunded pension liability. Unfortunately, there is no incentive for schools to do so—there is no mechanism to reduce their future district pension contributions, and they might not receive the full state match for prepaying.

Legislators should look to develop a formula for schools to “prepay” their pension contributions and get a credit for future costs. This could be done by creating separate accounts within PSERS that are invested, but still owned by public schools in order to pay their pension costs in future years.

Doing this could reduce the unfunded liability by several billion dollars and alleviate the pressure for higher property taxes.

To learn more about additional recommendations to solve Pennsylvania’s fiscal crisis, read our policy report, Blueprint for a Prosperous Pennsylvania.