Media

Pennsylvania’s Fiscal Condition is Critical

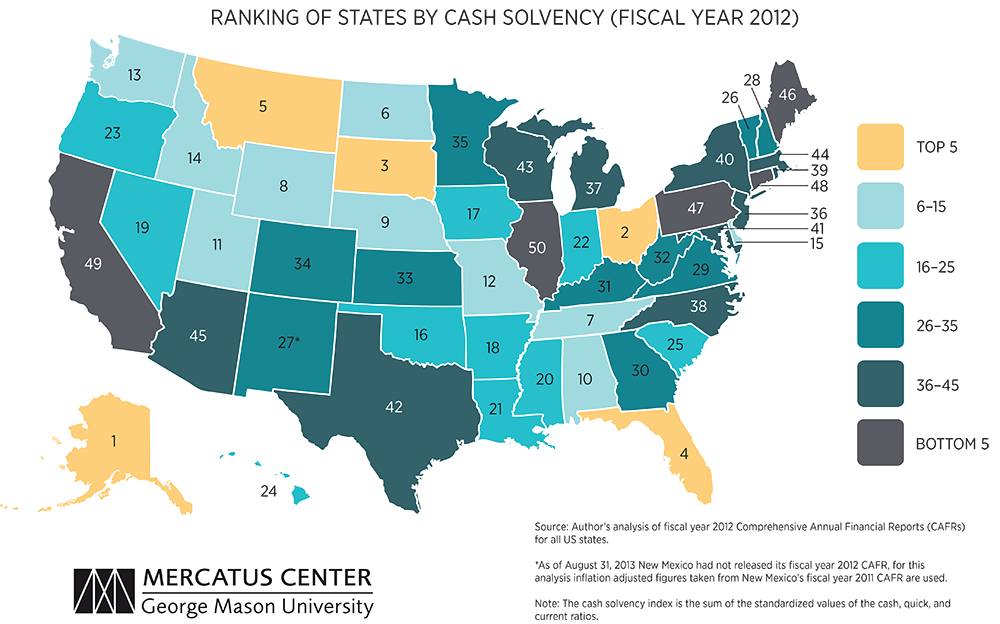

Pennsylvania ranks 42nd in overall fiscal condition, according to a report by Sarah Arnett of the Mercatus Center. The report, State Fiscal Condition: Ranking the 50 States, analyzes states’ abilities to meet their financial obligations.

Dr. Arnett uses four indices to determine state rankings: cash solvency, budget solvency to cover near-term bills, long-term solvency, and service-level solvency to provide residents with an adequate level of services. Due to low rankings in all four categories, Pennsylvania comes among the bottom 10 states in the overall fiscal condition.

Top performing states matched revenues and expenses, allowing them to pay short term bills and construct strategies for managing long-term liabilities. In contrast, bottom performing states have mismanaged at least one fiscal condition. More specifically, decades of irresponsible bond issuance, underfunded pension systems, rising health-care costs, and the appearance of balanced budgets—in short, poor financial management decisions on top of bad economic conditions—have harmed these states fiscal conditions.

Pennsylvania is guilty on each of these counts.

- The Independent Fiscal Office warns that federal stimulus dollars and reserves are running dry, yet state spending has reached an all-time high, surpassing $66 billion, an inflation-adjusted increase of $12,655 per family of four (or $3,163 more per resident).

- Combined state and local debt has reached $125 billion.

- Unfunded pension liabilities between the state’s two public pension systems total $47 billion.

- Both Fitch Ratings and Moody’s have downgraded Pennsylvania’s bond ratings, citing pension liabilities and limited reserves.

Already ranking 10th highest in the nation in state and local tax burdens, Pennsylvania’s bills are coming due, and absent reform, the burden on taxpayers will only get heavier.

The time has come to heed these warnings as our state leans further and further off the fiscal precipice.