Media

PA Manufacturing Withers Under High Tax Load

As Harrisburg searches for politically acceptable tax hikes to fund a record-breaking budget, Pennsylvania’s attractiveness to manufacturers continues to decline. According to a study reported by the Central Pennsylvania Business Journal, local manufacturers operate under an already onerous tax load.

The report, prepared by Ball State University’s Center for Business and Economic Research in Indiana, graded states on a number of factors, including benefit costs and tax climate. Manufacturing in the commonwealth earned a grade of C- this year, down from a C in 2015.

The study examines factors most likely to be considered by site selection experts for manufacturing and logistics firms, and by the prevailing economic research on growth, according to the researchers.

Michael Hicks, director of the research center, says high taxes are particularly problematic for Pennsylvania manufacturing.

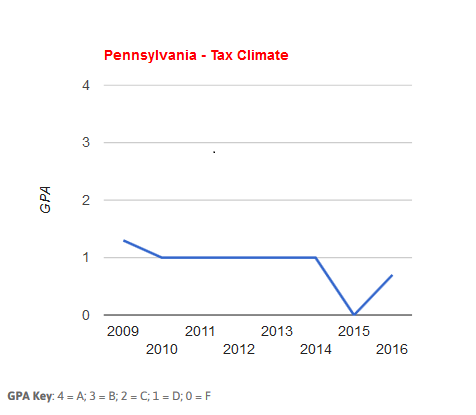

The Keystone State earned a D for worker benefit costs and a D- for tax climate in the study.

“I think it’s fair to state that in Pennsylvania the effective tax rate is rather burdensome,” Hicks said.

Pennsylvania, like many states, offers tax-abatement programs for business, but Hicks noted that they may not help.

“The problem is that most job growth in manufacturing comes from existing companies,” which may not have access to incentives aimed at startups, he said.

With Pennsylvania already bearing the 15th highest state and local tax burden in the nation and the state’s manufacturers withering under its weight, what good reason is there to increase taxes?

None is the answer.