Media

Bad Budget Trends Must Be Reversed

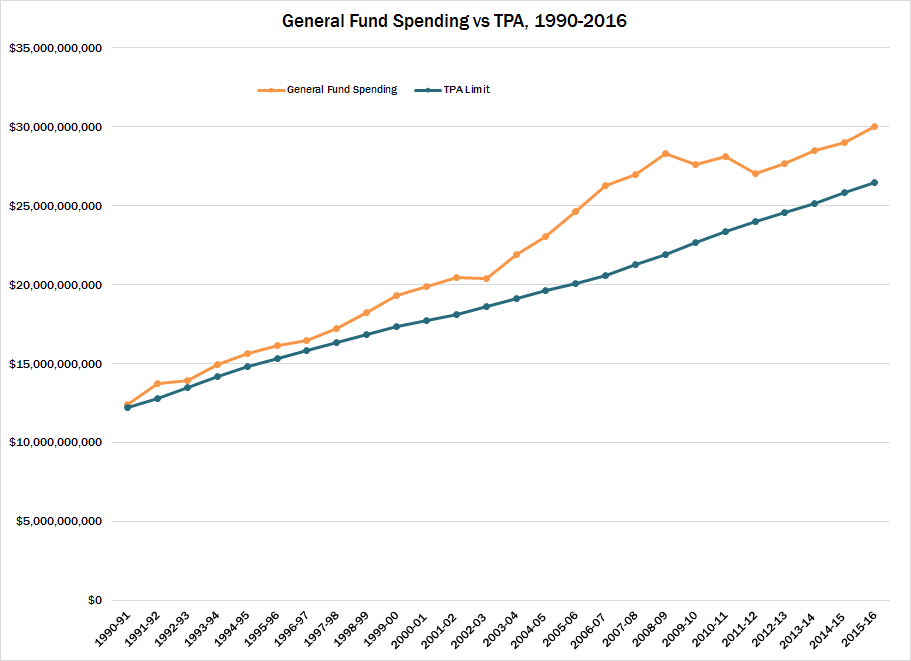

Government spending has gradually risen for decades, until it suddenly exploded during Gov. Ed Rendell’s tenure. After the profligacy of the Rendell years, spending growth stabilized, but it’s still on an unsustainable upward trend.

To help control the growth of spending, lawmakers can adopt annual spending caps consistent with the principles of the Taxpayer Protection Act (TPA). The TPA limits spending increases to inflation plus population growth to achieve four goals:

If lawmakers limited spending increases to the TPA index over the last 26 years, they would have saved taxpayers more than $3.58 billion or $1,119 per family of four.

The most recent budget came in under the TPA limit after adjusting spending to reflect transfers and payment delays. This represents an improvement over prior proposals, but the underlying causes of rising state spending remain.

| 2015-16 Budget vs TPA (Amounts in Millions) | |

| Inflation + Population Growth (TPA Index) | 1.71% |

| 2015-16 Budget | $30,031 |

| Amount Over TPA | $486 |

| Amount Over TPA + Adjusted Baseline | ($239) |

The Independent Fiscal Office estimates the Department of Human Services (DHS) alone will grow its budget by $835 million in 2016-17. In contrast, the TPA index would allow for a $306 million spending increase. It's clear state spending is on a dangerous trajectory when just one department's budget threatens to push spending over the TPA limit.

The surge in spending isn’t limited to DHS. Pension costs are inflating agency budgets across state government. If we fail to enact structural spending reforms, Pennsylvanians can expect to see higher taxes and slower economic growth for years to come.

To stave off a debilitating fiscal crisis, CF has proposed a variety of reforms to stem the tide of government spending. Here are just five:

1. Eliminate corporate welfare.

2. Improve the state’s welfare system.

3. Reduce public employee compensation inequality.

4. Reform pensions by moving new employees to a defined contribution plan.

5. Eliminate costly state mandates like prevailing wage.

These ideas would save hundreds of millions of dollars and slow spending to prevent harmful tax increases on working people.