Media

A Half-Billion Saved is a Half-Billion Earned

After April’s General Fund tax collections came in at 9 percent above forecasts, some lawmakers are clamoring to spend any surplus Pennsylvania has at the end of the year. Gov. Tom Corbett, however suggests being prudent and holding some back in reserve.

There are several reasons why Gov. Corbett’s advice should be heeded. For starters, one month of strong tax collections does not establish a trend. While April’s collections were ahead of estimates, March’s tax collections were behind. For the year, the state is 2.3 percent ahead of projections. (Note that many erroneously call this a “surplus”—in reality, it is merely a difference from estimates. The surplus is what the state has remaining after all spending occurs).

Secondly, Gov. Corbett’s proposed budget already relies on a surplus—starting the next fiscal year with $586 million in the bank. The state would end the fiscal year (based on Gov. Corbett’s budget book) with less than $4 million remaining. That is, the budget already spends more money than the state will collect in taxes.

Most importantly, Gov. Corbett and lawmakers must consider the annual budget in light of Pennsylvania’s long-term fiscal picture. Over the past eight years, state debt nearly doubled, growing by $21 billion. Annual interest payments on bonds tripled, to over $1.1 billion in the proposed budget—a total sure to rise.

This debt doesn’t include short-term borrowing, such as the $3 billion the commonwealth owes to the federal government for Unemployment Compensation, or the $1 billion in tax anticipation notes borrowed this year (money borrowed just to ensure state checks don’t bounce).

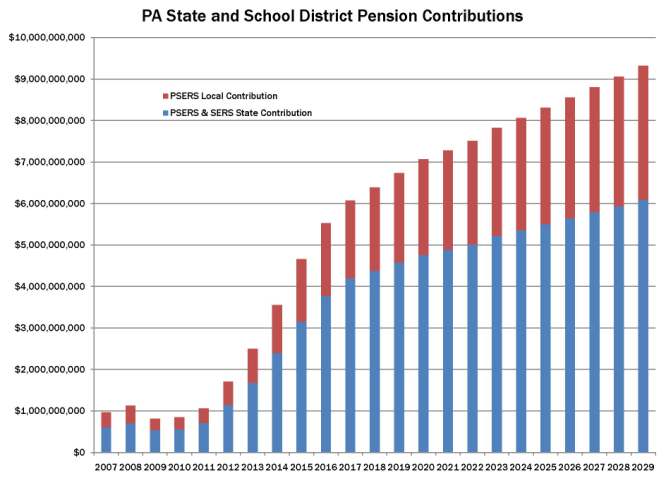

The largest looming cost on the horizon is our state pension payments. While Act 120 of 2010 delayed the “pension spike”, it created a pension staircase. Taxpayer contributions to pensions of state workers (SERS) and the state share for school district employees (PSERS) are projected to rise from $700 million this year to more than $4 billion by 2017, as the chart below shows. That is a 500 percent increase.

So yes, saving a few dollars for the future (or even putting any surplus into pensions) would be fiscally prudent.