Commentary

Severance Tax Benefits the Powerful at Citizens’ Expense

Note: This commentary first appeared in the Sunday Pittsburgh Tribune-Review.

Washington County farmer Shawn Georgetti was living paycheck to paycheck before the Marcellus Shale boom. Thanks to a natural gas lease, he’s finally been able to upgrade his 30-year-old equipment. “It’s a lot more fun to farm [now],” Shawn said. But a new severance tax on natural gas could put an artificial cap on thousands more stories like Shawn’s.

How? Every dollar sent to Harrisburg under a new tax prevents investments in equipment and exploration, hiring employees, and paying royalties to landowners. Make no mistake—some wells will not be drilled, property owners will lose royalty money, and people will lose jobs when money is diverted from producing gas to filling government coffers.

Those alleging that the gas industry does not contribute its “fair share” ignore $1.8 billion in state and local taxes paid in the last two years, $600 million in impact fees collected in the last three years, and billions paid to landowners in lease and royalty payments. In fact, a 5 percent severance tax, if it had been in place in 2011 and 2012, would have generated less money than the current impact fee.

Pennsylvania’s overall business climate, with the 10th highest tax burden in the nation, already squeezes drillers. We have the highest effective corporate income tax in the world—a tax that gas-producing states like Texas and Wyoming don’t even have at the state level.

Shale gas is found across the country and around the globe. Drillers can go elsewhere—and they know it.

The Fraser Institute’s Global Petroleum Survey 2013 dropped Pennsylvania down 24 spots—to 58th—in terms of investment attractiveness. Among the states ranked ahead of Pennsylvania are Oklahoma, Texas, Arkansas, West Virginia, and Ohio. In other words, we are losing our competitive edge.

Keeping the industry in Pennsylvania should be a priority.

In addition to the billions in royalties paid to landowners and farmers like Shawn Georgetti, the natural gas boom has benefited all Pennsylvanians with cheaper energy. Low natural gas prices helped poor families with a $10 billion-per-year reduction in utility bills, according to a Mercator Energy analysis.

The industry’s positive effect on the state’s economy is seen in the more than 240,000 people employed in Marcellus Shale-related industries in 2013, as reported by the Pennsylvania Department of Labor and Industry.

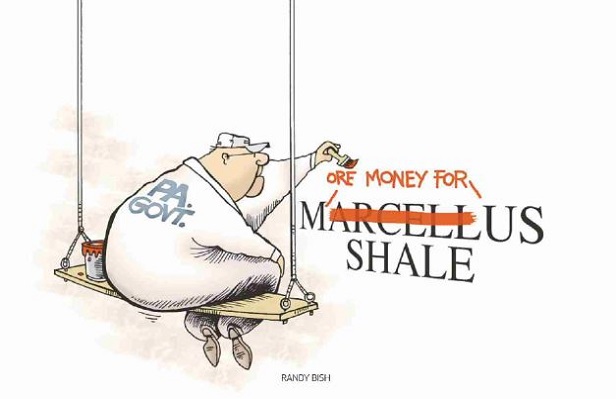

So, if millions of Pennsylvania families benefit from gas drilling and the industry already pays taxes common to every other business, who is pushing for yet another tax hike?

Answer: Powerful government union CEOs dependent on making big government even bigger.

Calls for new taxes on the gas industry have come from organizations such as the CLEAR Coalition and the Pennsylvania Budget and Policy Center—both funded by government unions like the American Federation of State, County and Municipal Employees and the Pennsylvania State Education Association.

Ironically, government unions’ campaign to target the gas industry and increase government spending works against the interest of private union workers employed in the gas fields and hundreds of supporting businesses.

“The shale became a lifesaver and a lifeline for a lot of working families,” said Dennis Martire of the Laborer’s International Union of North America (LIUNA) in an Associated Press report. Pipeline work in Pennsylvania and West Virginia increased from 400,000 hours in 2008 to 5.7 million in 2012, according to LIUNA, which represents workers in the construction trades.

Those proposing new taxes on the natural gas industry to spend more on schools, pay pension liabilities, or expand welfare programs act as though robbing Peter to pay Paul somehow makes everyone better off. Whether the “Peters” are farmers or pipe fitters, welders or waitresses, or simply consumers of gas and electricity, they will be made poorer by a severance tax.

Marcellus Shale development has improved the lives of millions. It would be wrong for a money-hungry government to undermine this gift of nature and free enterprise and leave farmers like Shawn Georgetti stuck in the past.

# # #

Gordon Tomb is a senior fellow for the Commonwealth Foundation (CommonwealthFoundation.org), Pennsylvania’s free market think tank.