Fact Sheet

Pennsylvania State Budget Trends, 2015

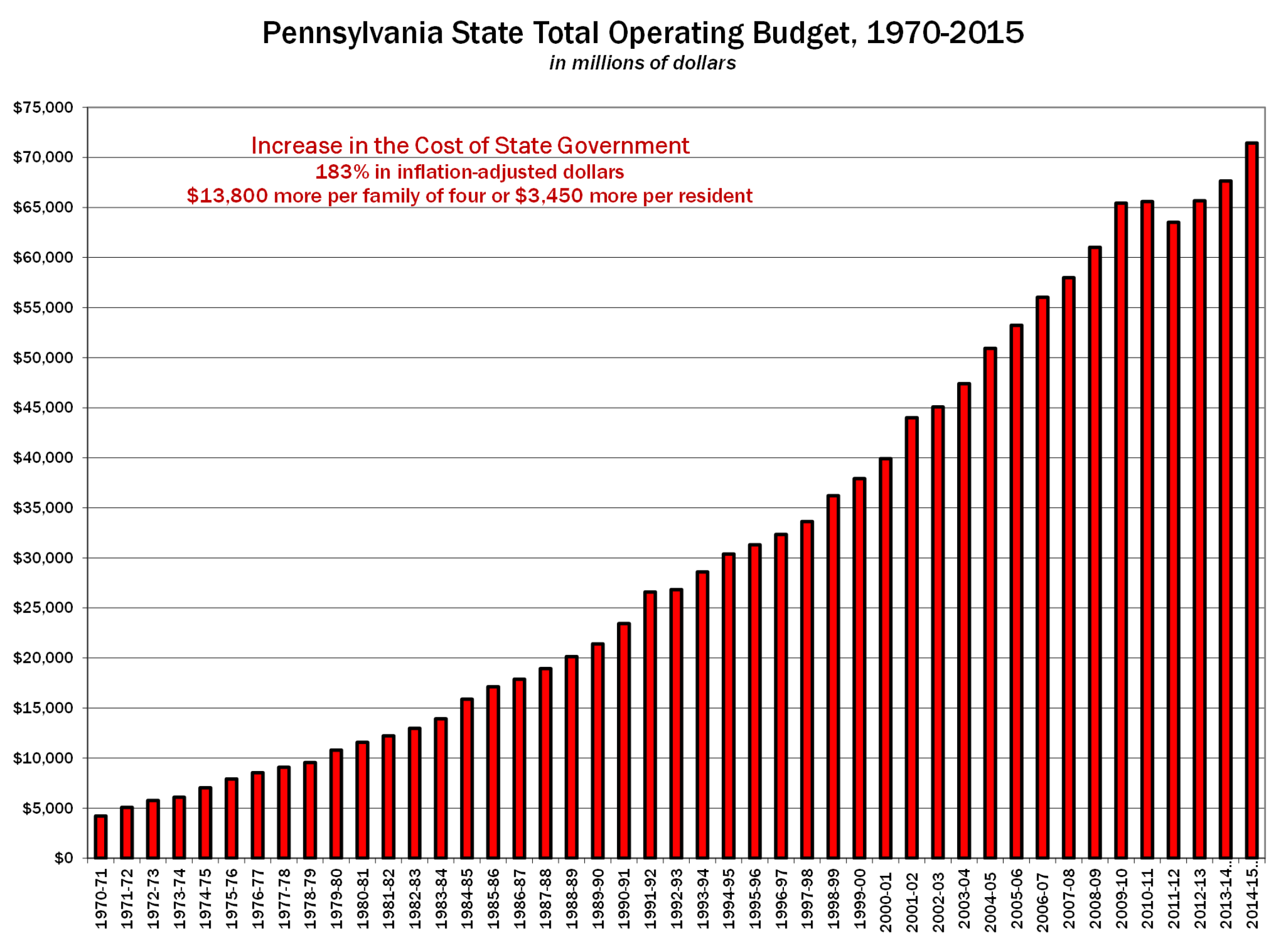

The enacted $29 billion General Fund budget (a 1.88 percent increase over 2013-2014) and $71.4 billion total operating budget represent Pennsylvania’s highest spending levels ever—exceeding years when federal stimulus dollars were used to balance the budget.

Spending Outpaces Inflation

- Pennsylvania’s fiscal challenges persist due to the state’s inability to control spending. From 1970 to 2015, state government increased spending from $4 billion to approximately $71.4 billion, an inflation-adjusted increase of $13,800 per family of four (or $3,450 more per resident).

- If state government had limited its total spending growth to inflation and population since 2000, taxpayers would be saving nearly $15.3 billion this year, or $4,767 per family of four ($1,191 per person).

Pennsylvania State Budget Basics

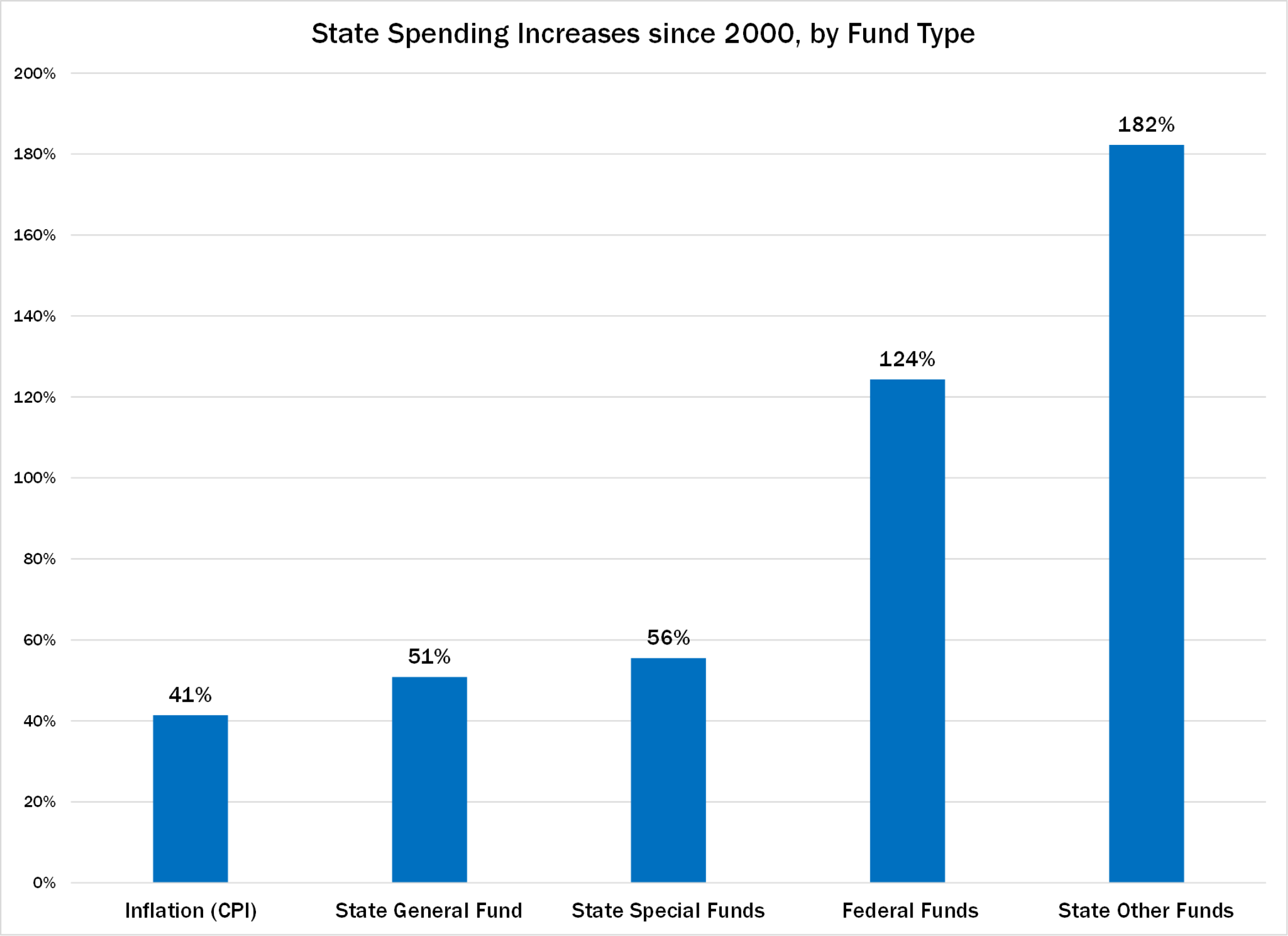

While the General Fund Budget is the primary focus of both legislative negotiations and public debate, it represents only about 40% of the commonwealth’s total operating budget.

- Total Operating Budget (estimated) – $71.4 billion

- General Fund Budget (enacted) – $29.0 billion

- Federal Funds (estimated) – $24.2 billion

- Special State Funds (estimated) – $4.8 billion

- Other State Funds (estimated) – $13.3 billion

- While growth in all areas of the state budget exceed the rate of inflation, growth outside of the General Fund is more rapid.

Pennsylvania is Overspending

- For the seventh consecutive year, Pennsylvania will spend more from the General Fund than the state will collect in taxes.

- Federal stimulus funds, transfers from the “rainy day fund,” and other one-time revenue sources have allowed lawmakers to spend beyond the state’s means for years.

- The projected deficit stems from expected spending increases. The Independent Fiscal Office’s forecast of a $1.7 billion deficit next year assumes a $1.8 billion spending increase.

- Without this projected increase, the forecasted deficit disappears.

- The IFO projected $2.55 billion General Fund Budget Deficit by 2020 assumes spending growth of $6.4 billion.

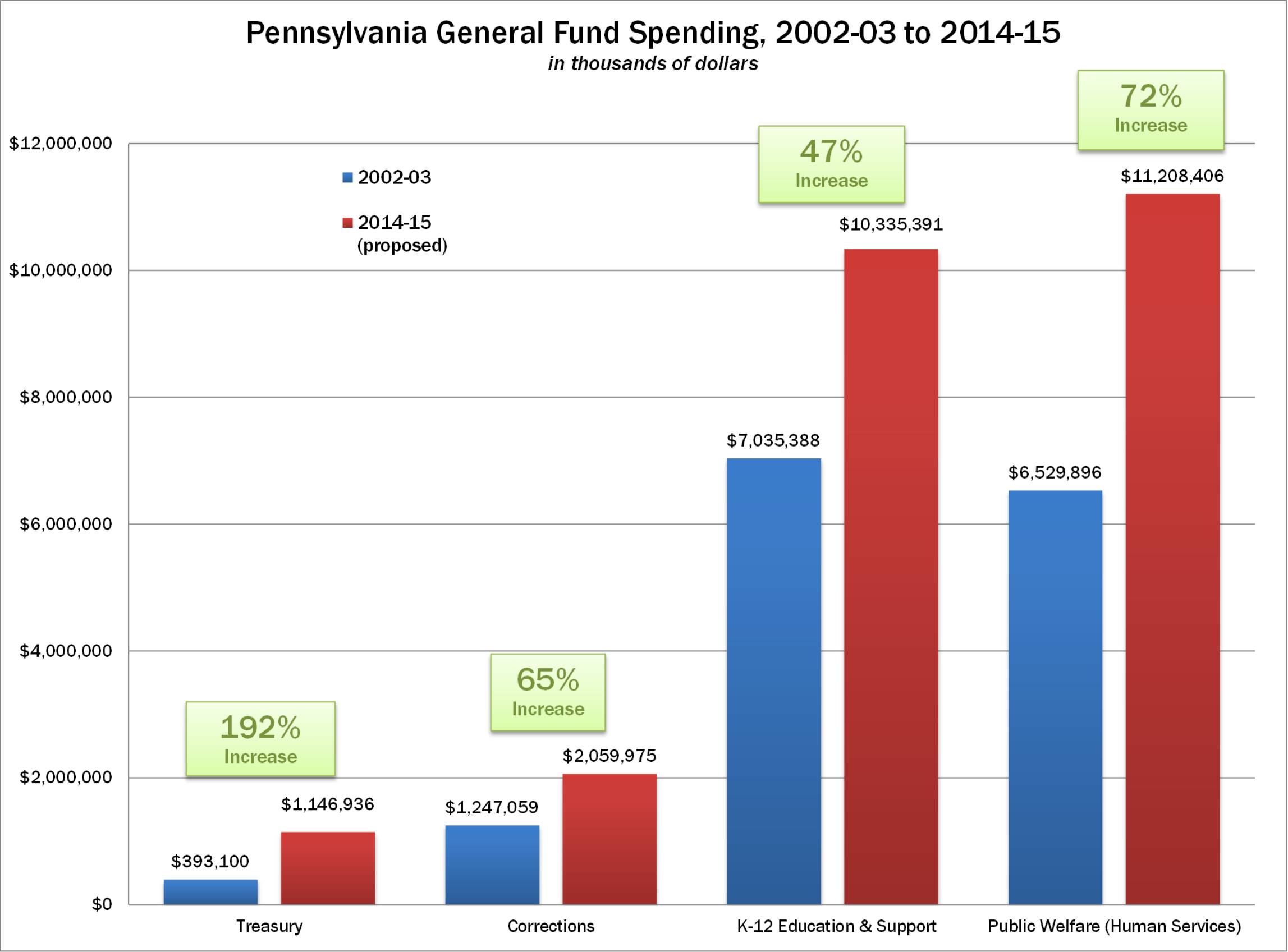

- General Fund spending has increased by approximately $8.6 billion (42%) since FY 2002-03, not including spending directed to other funds.

- Four categories (Welfare, K-12 Education, Corrections, and Treasury) represent about 86% of all General Fund spending.

- Since FY 2002-2003, spending in these four categories has increased by more than $9.5 billion (63%), while the rest of the budget has declined.

Education

- Despite the claims of billions in education cuts, $10.3 billion represents an all-time high in K-12 education spending.

- According to the National Center for Education Statistics, Pennsylvania was 10th in the nation in spending per student in 2010-11, at $14,956. This is nearly $3,000 more per student than the national average of $12,048.

- Rather than simply looking for more funding, lawmakers should consider a more equitable system of distributing tax dollars through Weighted Student Funding.

Rising Debt and Tax Burden

- From 2002 to 2013, Pennsylvania state debt—including debt held by state agencies—more than doubled, from $23.7 billion to $50.4 billion.

- Today, Pennsylvanians owe $133.6 billion in combined state and local government debt, or a little more than $10,400 for every man, woman, and child.

- Pennsylvania has the 10th highest state and local tax burden in the nation, up from 24th in 1991, according to the Tax Foundation.

- Pennsylvania taxpayers pay $4,374 per person in state and local taxes, or 10.3% of the state’s total income.

|

Pennsylvania State & Local Government Debt |

||

|

Debtor |

Debt Outstanding |

Per Person |

|

Total State |

$50,393,717,000 |

$3,941 |

|

State |

$11,188,917,000 |

$875 |

|

State Agencies & Authorities |

$39,204,800,000 |

$3,066 |

|

Total Local |

$83,229,451,000 |

$6,509 |

|

School Districts |

$26,382,245,737 |

$2,063 |

|

County/Municipal/Twp/Other |

$56,654,115,000 |

$4,431 |

|

Total |

$133,623,168,000 |

$10,450 |

|

Sources: Governor’s Executive Budget (http://www.budget.state.pa.us) December 2013 data; PA Dept of Education (http://www.pde.state.pa.us) June 2013 data; U.S. Census Bureau (http://www.census.gov) 2012 data |

||

Pensions

- Pennsylvania’s unfunded pension liability—the amount the state should have in pension funds to make payments for the benefits retirees and current workers have earned—now exceeds $50 billion.

- Because of past policy decisions, this unfunded liability will continue to grow, even as pension contributions rise.

- Taxpayer costs for pension contributions have been rising, and that trend will continue over the next few years. In the General Fund alone, pension contributions are projected to increase nearly 97% by 2019-20, from $1.7 billion to more than $3.3 billion. School districts will face similar increases in their pension contributions.

Overspending Hampering Economic Growth

- From 1991 to 2014, Pennsylvania has ranked a dismal 45th in job growth, 47th in personal income growth, and 48th in population growth.

- In contrast, states with lower tax burdens and slower spending rank high in these measures of economic growth.

# # #

To find more information on the Pennsylvania State Budget, visit CommonwealthFoundation.org/Budget