Memo

Governor Wolf’s 2015-16 Budget Myths

✗ Myth: Without tax hikes, the budget deficit will reach $2.3 billion and cannot be fixed.

✓ Fact: The IFO estimated a $1.6 billion budget deficit at the start of 2015. In practice, state deficits are about half of what is reported because spending forecasts are often higher than actual program costs.

The 2015-16 budget was balanced without tax hikes. Two ways exist to close a budget deficit: raise revenue or reduce spending. Lawmakers closed the projected budget deficit by spending less—$3.8 billion less than Governor Wolf’s original budget proposal.

✗ Myth: The increase in “mandated spending” for 2015-16 is $1.88 billion, for a total General Fund budget of $31.033 billion.

✓ Fact: The final 2015-16 budget spends $30 billion, a billion dollars less than the minimum spending cited by the administration. Human services, pensions, corrections, and other mandatory costs will continue to grow rapidly, but it’s clear the governor overestimated this year’s “mandated costs.”

✗ Myth: “HB 1801 does not add up. Once again, the math doesn’t work. The money it claims to provide doesn’t exist. This budget is not in balance.”

✓ Fact: The budget is balanced. However, it does not address Pennsylvania’s long term fiscal problems. Pennsylvania’s fiscal problems are so large that even Budget Secretary Randy Albright admits dramatic tax increases will not prevent future budget deficits. Only systematic changes, like true pension reform and slowing welfare spending growth, will solve the structural deficit.

✗ Myth: “We cannot afford another property tax hike at the local level and the only way you can keep from doing that is a modest increase in taxes at the state level.”

✓ Fact: Few would call a $3 billion dollar tax hike “modest.” Instead, reforms like voter referendums, school choice, and mandate relief can protect property owners from property tax increases without raising state taxes. Lawmakers tried to address the largest driver of property taxes, pensions, but the governor vetoed their reform plan.

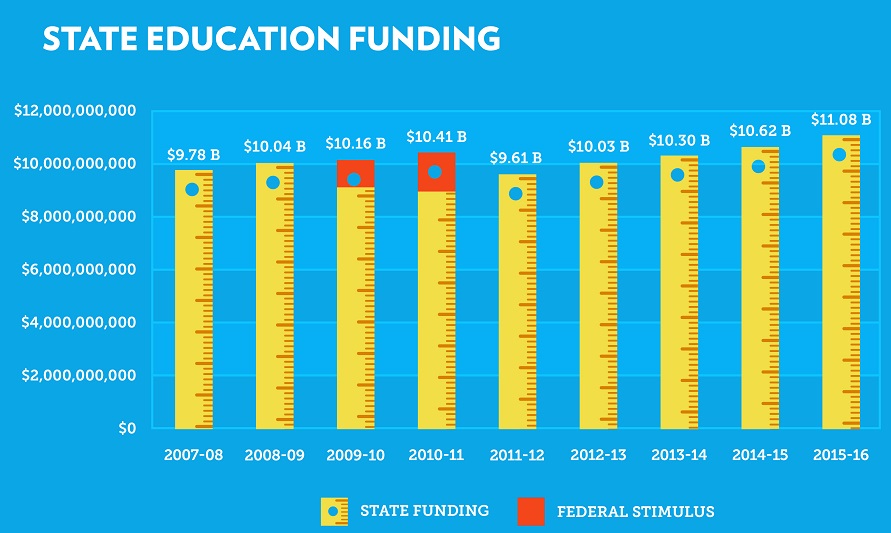

✗ Myth: “Their budget is an effective $95 million cut to school districts after years of cuts under previous Republican budgets.”

✓ Fact: The 2015-16 budget increases public school funding by $460 million. The only education line item reduced is school construction reimbursement. This is not a cut, but an effort to fund school district construction costs with $2.5 billion borrowing through state bonds. By vetoing the fiscal code, the governor is preventing borrowing for school construction and once again standing between schools and additional funding.

According to Secretary of Education Pedro Rivera, state lawmakers have never voted to cut education spending. Despite the expiration of federal stimulus funds more than five years ago, Pennsylvania ranks tenth highest in the nation in funding per student, at more than $15,000 per child.

✗ Myth: “I had worked patiently and persistently with Republican leaders over the past many months to agree on a compromise budget. … Then, before the final vote, the Republican House leaders told their members to go home.”

✓ Fact: The “budget framework” supposedly contained real pension reform, property tax controls, and real liquor privatization. However, when the vague agreement was translated into legislation, these reforms were absent. The bill also required a non-specified $1.6 billion tax hike package.