Fact Sheet

Embracing Innovation in State Government

Conventional governing is hampering Pennsylvania’s progress. Growing state budgets combined

with one-time revenue transfers and targeted tax hikes are delaying the structural reforms

essential to improving the quality of life for people who live and work in Pennsylvania.

If the state is to overcome its fiscal and economic challenges, policymakers must restructure government to improve the delivery of services and cut down on costs. The Commonwealth Foundation, in a recently released policy brief, outlines the short- and long-term reforms needed to meet these two goals. This fact sheet is a summary of our findings and recommendations.

Findings

- Over the last five decades, state spending has risen by more than $4,000 per person—an inflation-adjusted increase of 189 percent. In 1970, the state spent $2,122 for every Pennsylvanian. Today, that number is $6,132.

- The IFO projects spending will grow by approximately $8 billion over five years, with revenue growing by just $5.5 billion. The gap between spending and revenue growth ($2.5 billion) is a striking example of Pennsylvania’s spending problem.

- The bulk of projected spending growth comes from “automatic spending”—programs that will see spending increase due to inflation and population adjustments unless lawmakers make changes.

- The IFO projects Pennsylvania will end the current fiscal year with more than a $500 million deficit, despite the $650 million tax increase package passed last year. Higher taxes are not a solution. Reducing the take home pay of working people will further undermine our fiscal stability and economic progress. Indeed, states with the lowest tax burdens generally see faster income, job, and population growth than states with the highest tax burdens.

Immediate Cost-Saving Reforms

- Policymakers can achieve savings in the near term by reducing special subsidies and non-General Fund Spending. If half of this spending were redirected it would amount to an infusion of $1.3 billion to help balance the budget.

|

Summary of Funds Available for Immediate Cost-Savings |

|

|

Program |

Total Spending |

|

Public Transportation Trust Fund |

$1,221,568,000 |

|

Corporate Welfare |

$804,000,000 |

|

Public Transportation Assistance Fund |

$224,600,000 |

|

Multimodal Transportation Fund |

$138,733,000 |

|

Keystone Recreation, Park and Conservation Fund |

$93,000,000 |

|

Agricultural Conservation Easement Purchase Fund |

$60,000,000 |

|

Agricultural College Land Scrip Fund |

$50,000,000 |

|

Housing Affordability and Rehabilitation Enhancement Fund |

$13,000,000 |

|

Conservation District Fund |

$3,000,000 |

|

Total |

$2,607,901,000 |

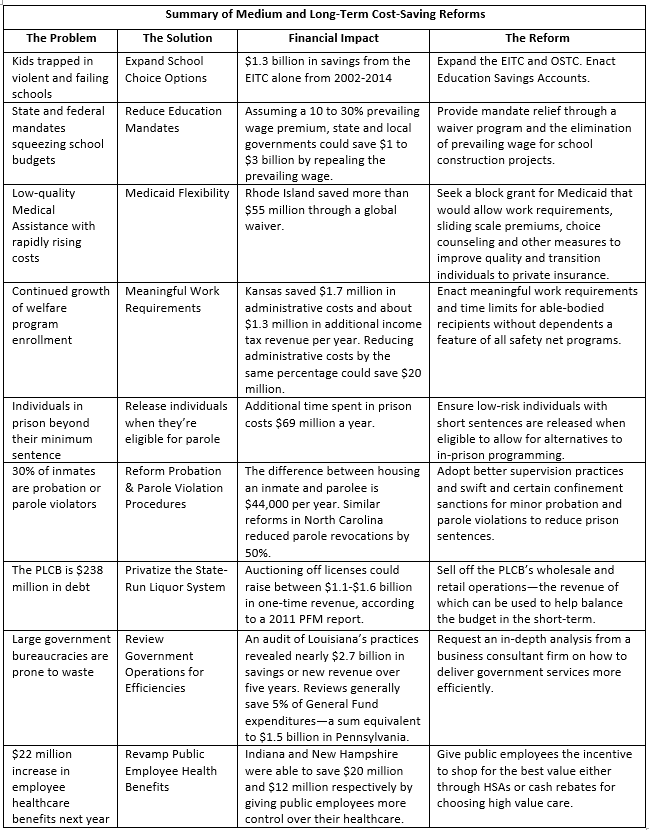

Long-Term Cost Saving Reforms

- Structural reforms to fix our broken systems are the only way to overcome the commonwealth's long-term challenges. The chart below identifies the problems, solutions, financial impact, and specific reforms needed to rescue state residents from decades of policy failures.