Press Release

Analysis: Wolf’s Latest Tax Plan Costs Families $1,000

Analysis: Wolf’s Latest Tax Plan

Costs Families $1,000—Vote Next Week

14,000 Jobs Not Created as a Result

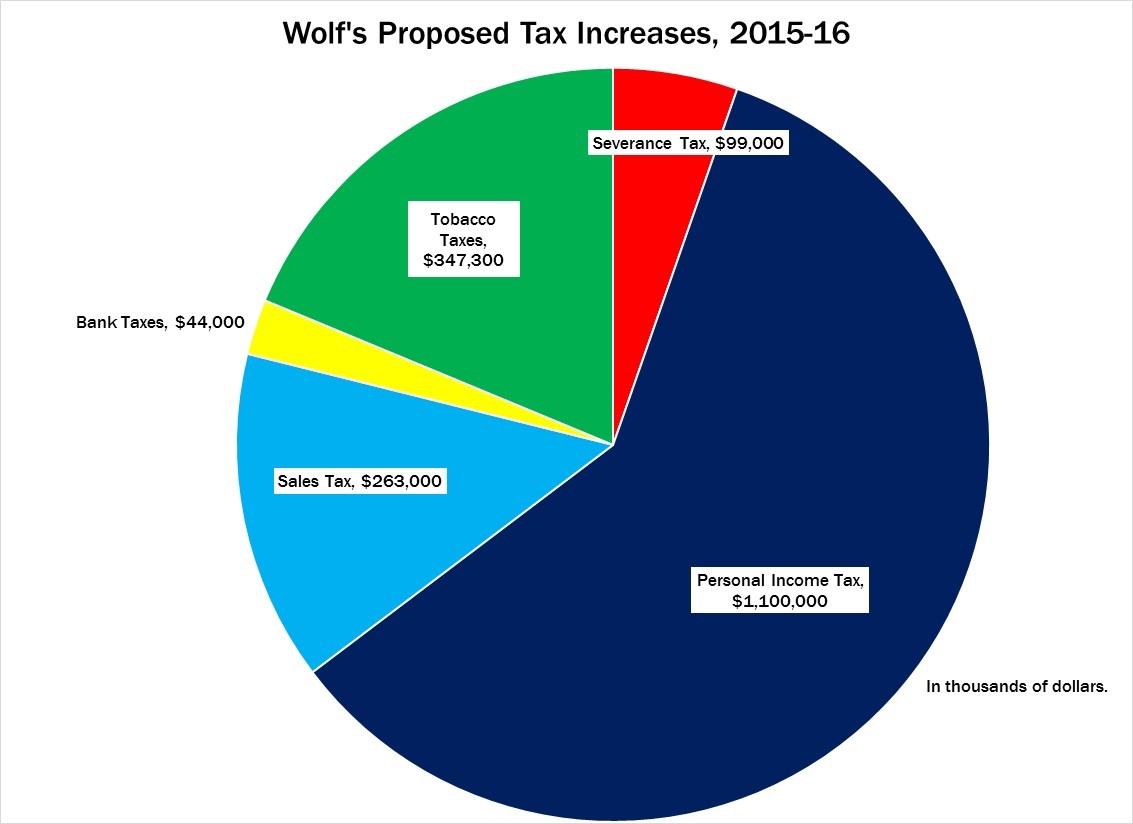

October 1, 2015, HARRISBURG, Pa.—Next week, the state House plans a full vote on Gov. Wolf’s modified tax plan, first proposed on September 11. This plan, despite being pared down from Wolf’s original $4.6 billion tax increase, would still result in a $1,000 tax increase per family of four in its first full year and would cause 14,000 jobs to not be created by 2016-17, according to a new analysis.

“Wolf’s latest plan remains a lose-lose for taxpayers, working families, and job seekers, who will see significantly higher tax bills and fewer job opportunities,” commented Nathan Benefield, vice president of policy analysis for the Commonwealth Foundation. “Property tax relief and corporate tax cuts have been dropped from the proposal, leaving a bevy of increases in sales, income, cigarette, and energy taxes that will hit Pennsylvanians of all income levels.”

A new analysis released today by the Commonwealth Foundation highlights four things to know about Wolf’s latest tax proposal:

1. Wolf’s tax hike hits Pennsylvanians with an increase of more than $1,000 per family of four when fully implemented.

2. There are zero property tax relief provisions included in this plan.

3. The severance tax (net of impact fee reimbursements) represents only 5 percent of new revenue in the first year, and 10 percent in the second year.

4. Wolf’s tax increase would result in the loss of 14,000 total jobs, once fully implemented.

Click here to view the full analysis.

UPDATE: Gov. Wolf offered a new tax proposal on October 6, 2015. Here is a summary of that plan

Nathan Benefield is available for comment. Please contact John Bouder at 570-490-1042 or [email protected] to schedule an interview.

# # #

The Commonwealth Foundation transforms free-market ideas into public policies so all Pennsylvanians can flourish.