Commentary

Government Can’t Cure Our Economic Woes

Pennsylvania is facing a deep shortfall in revenue which, through October, stands at $565 million. Putting this in perspective, the shortfall in 2002-03—which led to increases in the state personal income and cigarette taxes, as well as a new tax on cellular phone and long distance calls—was $497 million after 12 months. The current deficit blew by that figure a mere four months into the fiscal year.

Lawmakers must quickly figure out how to “pay” for this shortfall when they come to Harrisburg in January. While Gov. Rendell has taken some steps to address the problem, including a freeze on hiring state workers and banning taxpayer-funded out-of-state-travel, these measures are insufficient to fill the current budget gap. Lawmakers will have only two choices: 1) cut spending, or 2) raise taxes.

While the Commonwealth Foundation identified over $6 billion in possible spending cuts, Gov. Rendell seems keen on raising taxes. He continues to hand out grants for pork barrel projects while the state Treasurer recently suggested that government spending is the way to grow our economy during a recession.

Yet this idea has been discredited. Taxing and spending is merely a redistribution of wealth—it neither creates jobs nor offers incentives for productivity. In fact, high taxes undermine growth and punish success. Even presidential candidate Barack Obama understood—as did John F. Kennedy—that tax rates should be reduced (or at least not increased) during a recession. The experience in other states supports this approach.

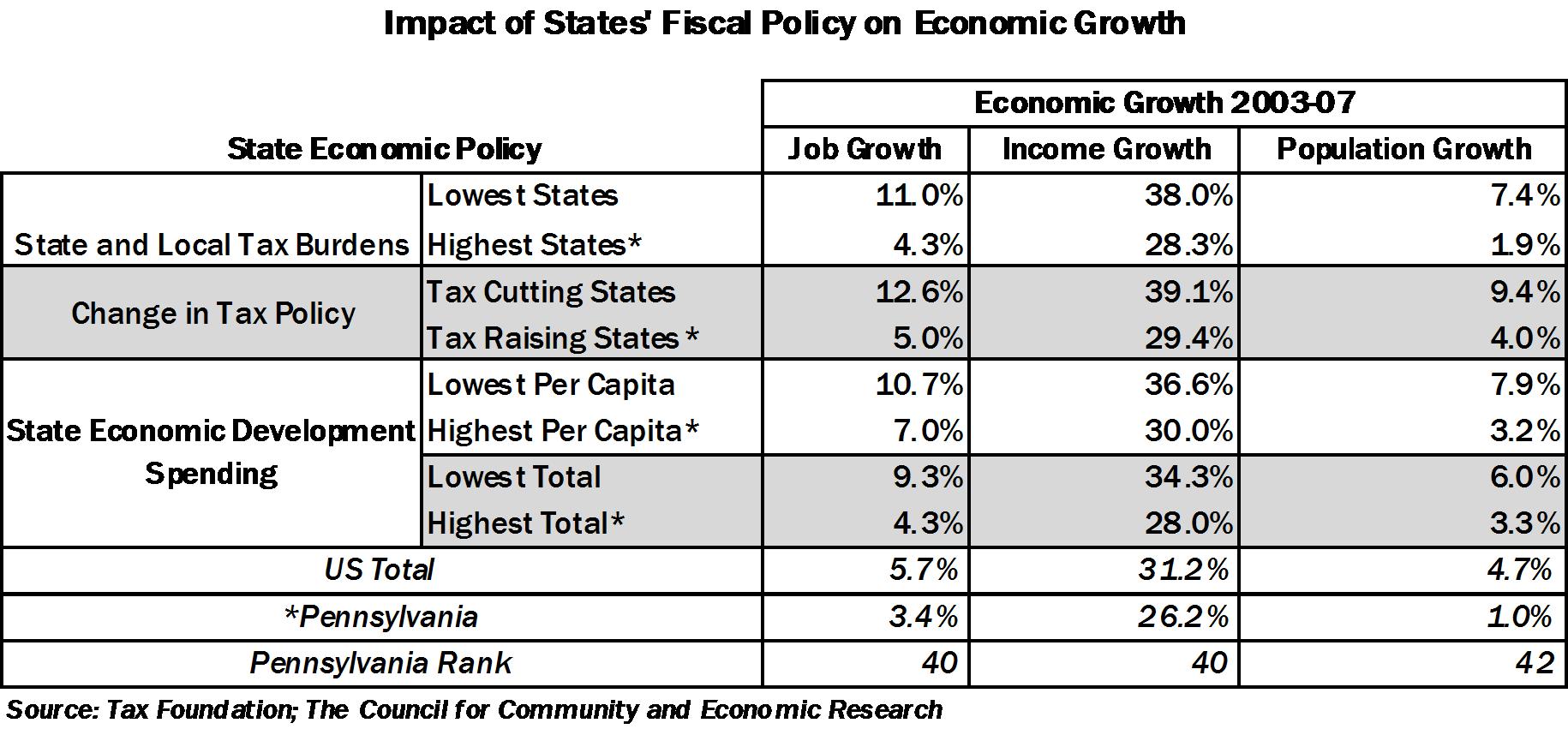

An analysis of the 50 states shows that those with the lowest tax burdens and those that cut taxes the most had much faster economic growth than those on the opposite end of the spectrum. According to the Washington, D.C.-based Tax Foundation, Pennsylvania ranks 11th in state and local tax burden, and 6th in tax burden increases since 2002. Not surprisingly, Pennsylvania ranks near the bottom in income, job, and population growth since Gov. Rendell took office, despite increased government “investment” in the economy.

The evidence is also clear on spending for so-called economic development—but in the opposite direction. States that spent the most on “economic development” in 2005 and 2006 had slower economic growth than states spending the least. According to a survey of the states, Pennsylvania ranks second in economic development spending only to Ohio—another state with a struggling economy.

Imagine the economy as a swimming pool. Splashing water from the shallow end to the deep end does not increase the amount of water in the pool. Likewise, the redistribution of income through economic development spending will not increase a state’s (or a nation’s) economic growth. The only way to achieve real economic growth is to have greater private sector productivity.

It is true that some government actions support productivity. Transportation infrastructure, education (both areas we should look more to the private sector to provide), public safety, protection of property rights, and other core functions of government promote economic growth. However, it is how efficiently government performs these functions—not how much taxpayers are forced to spend on them—that aids productivity.

Furthermore, Gov. Rendell’s economic policy of taking money from taxpayers to “invest” in the economy by giving handouts to certain energy companies, sports team owners for new stadiums, struggling department stores, and other corporate welfare schemes does nothing to improve our economy.

It should be noted that many states have avoided a fiscal crisis during this economic downturn. What do these states have in common? Not surprisingly, the answer is lower taxes and a recent record of cutting them. Thus, these states have enjoyed significantly stronger economic growth.

Gov. Rendell’s solution is to revisit the failed policies of the 1930s, 1970s, and even the recent blunders in Washington to try to tax, borrow, and spend our way out of a recession. The lesson from prospering states, however, is that reducing spending, lowering taxes, and relying on the private sector—not the public sector—is the way out of a recession.

# # #

Nathan A. Benefield is Director of Policy Research with the Commonwealth Foundation (www.CommonwealthFoundation.org), an independent, nonprofit public policy research and educational institute based in Harrisburg.